Product

If you are resident of the United States, Canada, or Australia, read our full international trading guides below. Similarly, if you are looking for an international forex broker, we have a separate tool for choosing a broker through our sister site, ForexBrokers.com. Claims that 98-99% of trades are executed successfully, average execution speed not provided. Overall, Pepperstone offers an excellent choice of third party platforms, along with low spreads for Razor account holders. Overall, CMC offers the widest choice of currency pairs by some margin, along with one of the lower average spreads on GBP/USD. Claims that 99.7% of trades are executed successfully, information on average execution speed was not provided.

In conjunction with the wide range of tradable instruments and London-based customer support, it cemented the broker’s number 1 spot. The second account is the Razor which offers ECN-style spreads plus a £2.25 per side commission. By charging a modest commission, the broker can offer their Straight Through Processing (STP) technology, ensuring prices quoted are direct from liquidity providers. We created a calculator that factors in average spreads plus commissions of the Razor account to similar FCA-regulated brokers to show how competitive their brokerage is. Clear Currency’s emphasis on personal service, combined with their suite of specialist tools, positions them as a top choice for those seeking to make international payments.

Lastly, you’d be wanting to be able to log in with ease from your phone so they would have to have a fully functional app or a very mobile-friendly site that you could log into using your browser. Yes, you can convert and transfer funds over the phone with a currency broker. Dealing online is easier, faster and safer than ever, but you may find having a broker at the end of the phone beneficial, especially for larger currency transfers.

Some international banks may offer free withdrawals from their ATMs worldwide. For example, premier customers at Citibank can access the Citigold lounge at Canary Wharf to withdraw EUR and USD from its Travel Money ATM⁵. In theory, £1, but a currency broker will expect clients to transfer london forex brokers a minimum of £10,000 at some point to make their services cost-effective. Check our currency broker tables to see which currency broker offers the most currency pairs. CMC Markets is regulated by some of the most important global financial regulators, including five Tier-1 jurisdictions.

A bureau de change is a business that makes its profit by buying foreign currency and then selling the same currency at a higher rate; I’ve included a few options for these in the next section. Before jumping into exchanging currency, it helps to understand how foreign currency and exchange rates work. Some currency brokers can only send money to major destinations, whilst others offer a more comprehensive service and you can send currency to almost anywhere. An experienced media professional, John has close to a decade of editorial experience with a background that includes key leadership roles at global newsroom outlets. He holds a Bachelor’s Degree in English Literature from San Francisco State University, and conducts research on forex and the financial services industry while assisting in the production of content. That said, there is an exception for tax obligations if you are trading forex via spread betting.

However, firms like Assure Hedge offer a simple options product for private clients. Global Reach is the best currency broker we feature that also offers currency options alongside large money transfers for businesses and individuals. All currency brokers that operate in the UK must be regulated by the FCA. The FCA is the Financial Conduct Authority and is responsible for ensuring that UK currency brokers are properly capitalised, treat customers fairly and have sufficient compliance systems in place. We only feature currency brokres that are regulated by the FCA, where your funds are protected by the FSCS. Our research team, led by Steven Hatazkis, conducts thorough testing on a wide range of features, products, and services.

Each year, we collect thousands of data points and publish tens of thousands of words of research. Assist individuals in selecting optimal remittance providers to affordably transfer money internationally. Cover remittance companies, their benefits over banks, various transfer methods, and the impact of mobile transfers in sub-Saharan Africa. Gain tips on saving on fees, avoiding pitfalls, and effectively supporting families, making investments, and managing finances abroad. If a currency broker seems very aggressive to win your business at the outset and offers rates which seem ‘too good to be true’ then the chances are they’re more likely to engage in this sort of activity. Currency brokers make most of their money from the exchange rate margin they apply to currency exchange.

Demo account users are given 4 weeks to practise and a virtual balance of £100,000. XTB is a forex and CFD exchange-listed firm regulated by the FCA and accepts UK residents. The broker provides comprehensive market access to various asset classes, including Forex, Indices, Stocks and ETFs.

This broker list is sorted by the firm's ForexBrokers.com Overall ranking. They may offer ultra-competitive margins on the initial one or two trades to gain your trust but then start to widen the margin over time. When registering with a new currency broker, compare quotes from at least two currency brokerage companies. Most brokers have third party compliance tools which help them get customers from “enquiry” into “authorised to trade” instantly or almost instantly.

Forex trading apps include Alarm Manager, Correlation Matrix and Trader, Mini, Trade Terminal, and Stealth Orders. The indicator package includes Donchian, Chart-In-Chart, and Renko Bar charts. The provider also won similar awards in other regions, including Australia and Singapore. It has been argued that Forex is not a zero-sum game as not all participants in the spot market are making speculative transactions.

In the vast financial landscape, currency brokers play a pivotal role, especially in an increasingly globalised world where businesses, investors, and even individuals frequently need to transact across borders. Their expertise lies in navigating the complexities of the foreign exchange market, which is one of the most liquid and dynamic markets globally. A negative sum game is any game or activity where the sum of total gains and losses is negative i.e., below zero. The reason why spot Forex can be considered a negative sum game is that traders incur substantial costs when trading the currency markets.

MT4 is great for trading CFDs, especially forex, do not use this platform if you wish to trade shares. Unlike MT4 or MT5, you will pay commission costs; shares, cryptos, and futures are unavailable. This platform is available as a webtrader for browsers and an app for iPhone, iPad, smartwatches, and Android devices. Your spread cost is among the most important factors when choosing a broker. After all, you pay a spread cost each time you open and close your position (per 100,000 lots). There are two trading accounts, the standard account and the razor account.

Leverage is the use of borrowed money (called capital) to invest in a currency, stock, or security. By borrowing money from a broker, investors can trade larger positions in a currency. As a result, leverage magnifies the returns from favorable movements in a currency's exchange rate.

A vast majority of trade activity in the forex market occurs between institutional traders, such as people who work for banks, fund managers and multinational corporations. These traders don’t necessarily intend to take physical possession of the currencies themselves; they may simply be speculating about or hedging against future exchange rate fluctuations. The forex market is a global electronic network of banks, brokers, hedge funds, and other traders. This market is where one currency is traded against the other in an effort to turn a profit. For instance, before the 2008 financial crisis, shorting the Japanese yen (JPY) and buying British pounds (GBP) was common because the interest rate differential was substantial. Currencies are traded worldwide in the major financial centers of Frankfurt, Hong Kong, London, New York, Paris, Singapore, Sydney, Tokyo, and Zurich—across almost every time zone.

So, a trade on EUR/USD, for instance, might only require a deposit of 2% of the total value of the position for it to be opened. Meaning that while you are still risking $10,000, you’d only need to deposit $200 to get the full exposure. Let’s take the Euro for example, and let’s say a trader has optimistic projections for the European economy and would thusly like to get long the currency. But – let’s say this investor is also bullish for the US economy, but is bearish for the UK economy.

How to day trade forex markets.

Posted: Fri, 13 Jan 2023 10:35:45 GMT [source]

The foreign exchange market is open 24 hours a day, five days a week – from 3`am Sunday to 5pm Friday (EST). So, you can trade at a time that suits you and take advantage of different active sessions. Approximately $5 trillion worth of forex transactions take place daily, which is an average of $220 billion per hour. https://g-markets.net/ The market is largely made up of institutions, corporations, governments and currency speculators. Speculation makes up roughly 90% of trading volume, and a large majority of this is concentrated on the US dollar, euro and yen. Currencies are traded in lots – batches of currency used to standardise forex trades.

There are some major differences between the way the forex operates and other markets such as the U.S. stock market. A great deal of forex trade exists to accommodate speculation on the direction of currency values. Traders profit from the price movement of a particular pair of currencies.

The spot market is the largest of all three markets because it is the “underlying” asset on which forwards and futures markets are based. When people talk about the forex market, they are usually referring to the spot market. When the euro fell, and the trader covered the short, it cost the trader only $110,000 to repurchase the currency. The difference between the money received on the short sale and the buy to cover it is the profit. There are some fundamental differences between foreign exchange and other markets.

Currencies in the FX market are quoted as pairs, so you essentially speculate on whether one currency will rise or decline in value against another. Making sure you’re aware that every time you place a trade, it could result in you losing money. This mindset will help you manage trades correctly and stick to your strategy. Using forex robots is ideal for people who do not have the time to trade the markets but still wish to try and make a return on their capital. Forex robots are usually sold by 3rd party providers and only require a quick installation before being ready to use.

Alternatively, if you think a pair will increase in value, you can go long and profit from an increasing market. Below are examples of margin requirements and the corresponding leverage ratios. You can basically use any modern computer or laptop that has internet access. Finally, it’s essential to use a broker that is suitable for your trading needs. Also, using a regulated broker such as eToro is crucial as it prevents you from being scammed or from having your details breached. As the forex market is so large and there are so many moving parts, we’ll break down some of the critical components below, helping you understand how it works and how you can get involved.

When it comes to trading currencies, the key to remember is that yield drives return.Every currency comes with an interest rate set by that country's central bank. A currency trader can accrue interest on the difference between the interest rate of the currency they sold and the currency they bought. By strictly focusing on these eight countries, we can take advantage of earning interest income on the most creditworthy forex trading explained and liquid instruments in the financial markets. Economic data is released from these countries on an almost daily basis, allowing investors to stay on top of the game when it comes to assessing the health of each country and its economy. Experts suggest trying a combination of both fundamental and technical analysis in order to make long-term projections and determine short-term entry and exit points.

The forex market offers one of the highest amounts of leverage available to investors. Leverage is essentially a loan that is provided to an investor from the broker. The trader's forex account is established to allow trading on margin or borrowed funds. Some brokers may limit the amount of leverage used initially with new traders. In most cases, traders can tailor the amount or size of the trade based on the leverage that they desire.

Traders can also use trading strategies based on technical analysis, such as breakout and moving averages, to fine-tune their approach to trading. The currency pairs serve to set the value of one vs. another, and the exchange rates will continuously fluctuate based on the respective changing values. The longer answer is that the market is big enough for all market participants.

Users can read various guides and articles and even use the Capital.com TV feature, which analyses current market events. Finally, Capital.com ensure they are accessible to everyone with a low minimum deposit of only $20, which can be made via credit/debit card, bank transfer, or various e-wallets. Spreads are the difference between the bid and ask prices offered by a broker. Bid and ask prices refer to the cost to buy and the money you’d receive to sell a specific currency. These tend to differ, as the broker gets the difference as a sort of ‘commission’ for helping facilitate your trade. Market sentiment, which is often in reaction to the news, can also play a major role in driving currency prices.

What’s more, of the few retailer traders who engage in forex trading, most struggle to turn a profit with forex. CompareForexBrokers found that, on average, 71% of retail FX traders lost money. This makes forex trading a strategy often best left to the professionals. They are the most basic and common type of chart used by forex traders.

As a result, currencies tend to reflect the reported economic health of the country or region that they represent. If you want to open a long position, you trade at the buy price, which is slightly above the market price. If you want to open a short position, you trade at the sell price – slightly below the market price. The first currency listed in a forex pair is called the base currency, and the second currency is called the quote currency.

What Is SMC (Smart Money Concepts) Forex Strategy?.

Posted: Tue, 31 Jan 2023 09:24:07 GMT [source]

Forex trading involves buying and selling the exchange rates of currencies with the goal that the rate will move in the trader’s favor. Forex currency rates are quoted or shown as bid and ask prices with the broker. If an investor wants to go long or buy a currency, they would be quoted the ask price, and when they want to sell the currency, they would be quoted the bid price. For example, an investor might buy the euro versus the U.S. dollar (EUR/USD), with the hope that the exchange rate will rise. Assuming the rate moved favorably, the trader would unwind the position a few hours later by selling the same amount of EUR/USD back to the broker using the bid price. The difference between the buy and sell exchange rates would represent the gain (or loss) on the trade.

The forward points reflect only the interest rate differential between two markets. They are not a forecast of how the spot market will trade at a date in the future. The forex market is unique for several reasons, the main one being its size. The Forex market trades over $5 trillion per day compared to $200 billion for the equities market. While the average investor probably shouldn’t dabble in the forex market, what happens there does affect all of us. The real-time activity in the spot market will impact the amount we pay for exports along with how much it costs to travel abroad.

Make sure to keep an eye on your trades so that you do not end up missing out on potential profits. This strategy protects you against short-term market volatility, and is geared more toward preventing loss than creating large gains. When you see news such as the Central Bank of Israel purchasing $30 million in forex, assess your positions to determine whether hedging might protect you from resulting market volatility. Foreign currency options are one of the most popular methods of currency hedging. As with options on other types of securities, foreign currency options give the purchaser the right, but not the obligation, to buy or sell the currency pair at a particular exchange rate at some time in the future.

Currency pairs with a positive correlation tend to move in the same direction. This is particularly useful when you have a stop-loss order, but the market moves against you before the stop-loss is hit. In such situations, you may use hedging to protect profits while waiting for the market to stabilize. With such a large market, currency fluctuations can occur quickly and unexpectedly, making hedging an important tool for traders.

Once you feel ready to perform your forex hedging strategy on real-time markets by opening a Cent account or a Standard account. Using CFDs is considered one of the best Forex hedging strategies, as it allows traders to easily go short or long. This strategy sees traders opening a contract with the broker solely based on the price direction the currency pair is expected to take. One classical tactic includes taking an operationally opposing position to the initial position he/she has taken in the market using a given CFD instrument. While the hedge mitigates the risk arising from the initial position in the short term, it also reduces the potential for profit from the original trade as well. As a money management tool, hedging is highly regarded as one of the most popular techniques to protect a trading account from potential swings that might affect a portfolio.

Recall our first plain vanilla currency swap example using the U.S. company and the German company. There are several advantages to the swap arrangement for the U.S. company. First, the U.S. company is able to achieve a better lending rate by borrowing at 7% domestically as opposed to 8% in Europe. The more competitive domestic interest rate on the loan, and consequently the lower interest expense, is most likely the result of the U.S. company being better known in the U.S. than in Europe.

Capital is protected against related security price changes, extreme forex movements, exchange rates, inflation, etc. FX options are a form of derivatives products that give the trader the right, but not the obligation, to buy or sell a currency pair at a specified price with an expiration date at some point in the future. Forex options are mainly used as a short-term hedging strategy as they can expire at any time. The price of options comes from market prices of currency pairs, more specifically the base currency. The trader could hedge a portion of risk by buying a call option contract with a strike price somewhere above the current exchange rate, like 1.4275, and an expiration date sometime after the scheduled vote.

On the other hand, if the USD/JPY price point increases, you can close your second (hedged) position in order to collect the profits from this upswing. Hedging moves past beginniner forex trading into more sophisticated ways to reduce your risk. Imagine you have a position that you believe may soon take a downturn due to an event in the market.

Party B, the counterparty of the swap may likely be a German company that requires $5 million in U.S. funds. Likewise, the German company will be able to attain a cheaper borrowing rate domestically than abroad—let's say that the Germans can borrow at 6% within from banks within the country's borders. Now you know what forex hedging is, the different types of strategies, which factors to consider when applying the hedging strategies, and the pros and cons of forex hedging.

A New Way to Hedge Forex Could Unlock Trillions for Clean Energy.

Posted: Tue, 13 Jun 2023 07:00:00 GMT [source]

Here are a few pitfalls that snag traders who implement hedging strategies. From there, you can then hedge with that currency or currency pair to offset the risk of your entire portfolio. Traders use the options to bet for or against the currency pair they own or another. I know that EUR forward contracts have a correlation of +0.8 to the EUR/USD.

The world of forex trading can be volatile and unpredictable, with sudden market shifts and unexpected events creating uncertainty for even the most seasoned traders. Say the announcement happens, and EUR/JPY maintains its same price or even increases. In this case, you are not obligated by the put option contract, and could even benefit from profits that it sees. Now, if the price of USD/JPY drops significantly, you will be able to close both of your positions, which will reflect your earnings from the previous price changes before the downturn.

This is due to the UK and EU relationship, both in terms of geography as well as political alignment – though the latter have changed recently. Much like options, currency forwards also let traders have the opportunity to lock in the price of the asset in advance. While these two are very similar, forwards are over-the-counter products unlike futures contracts, which are exchange-traded.

If the USD strengthens, the gains from the short position in the GBP/USD will offset some of the losses from the long position in the EUR/USD. In this scenario, you could hedge your long position in the EUR/USD by taking a short position in the GBP/USD. For example, let's say you've gone long on the EUR/USD currency pair, but you're starting to get nervous about potential downside risks. Another situation where you may use forex hedging is when you are uncertain about the market's direction.

You may not be able to open a position that completely cancels the risk of your existing position. Instead, you may create an “imperfect hedge,” which partially protects your position. You can buy options to reduce the risk of a potential downside or upside, depending on which way you believe your pair may be going. It’s important to note that this kind of hedging is not allowed in the United States, and you should generally be familiar with U.S. forex regulations. The opening of a contrary position is regarded as an order to close the first position, so the two positions are netted out.

Let's take an example of a political situation, say, trading the US election. We could use a forex correlation hedging strategy for this, which involves choosing two currency pairs that are directly related, such as EUR/USD and GBP/USD. Let’s say that a trader decides to make a ‘call option’ and buy an amount of EUR/USD, but thinks that there may be a fall in price.

This strategy focuses on choosing two currencies in the market that, in most cases, have a positive correlation, meaning that the price mostly moves in the same direction. There is also the risk of hedging resulting in increased losses in the portfolio or fund, due to some hedged trades not being correlated directly to initial positions, due to a different leverage or some other factor. This has the potential for aggregate drawdown or loss in the overall position when price volatility ensues. https://1investing.in/ is a trade protection mechanism used by traders trading with foreign exchange currency pairs. Essentially, the trader adopts a strategy to protect the initial position he/she has opened from an opposing move in the market.

In this case, this will help you to learn and anticipate movements that happen within the forex market. While the net profit of your two trades is zero while you have both trades open, you can make more money without incurring additional risk if you time the market just right. The cost of the hedge can include transaction fees, commissions, and other charges that your broker may charge. It would help if you weighed the cost of the hedge against the potential profits to determine whether the hedge is worth implementing. The charts above show that while the USD/CHF increased between May 21 and November 25, the EUR/USD declined. If you were short on USD/CHF, you would have limited your risks by taking a short position on EUR/USD.

He can then make a ‘put option’ and short-sell an equal amount of foreign currency at the same time in order to profit from the fall in price. This way, the trader is hedging any currency risk from the declining position and this is more likely outstanding check to protect him from losses. When it comes to hedging Forex, traders use hedging with correlating currency pairs. This strategy involves taking positions in two currency pairs with a high positive or negative correlation to mitigate risk.

One way to hedge your position would be to take a short position on the same currency pair, essentially betting against yourself. If - at the time of expiration - the price has fallen below $0.75, you would have made a loss on your long position but your option would be in the money and balance your exposure. If AUD/USD had risen instead, you could let your option expire and would only pay the premium. Though the net profit of a direct hedge is zero, you would keep your original position on the market ready for when the trend reverses.

Analysis: Low rupee volatility lulls Indian firms into hedging less.

Posted: Fri, 28 Jul 2023 07:00:00 GMT [source]

Hedging is a good strategy to utilize in forex for risk management purposes during trading. The investor or trader could seek to utilize this proven tactic in order to achieve his/her specific goal in the process. Used correctly, it is effective in protecting capital and profit margins for both retail and institutional players in the market. Otherwise, the bank will allow the contract to expire without utilizing the option as it would be able to sell its US dollar profits into euros for a better rate in the market.

Content

The fact is that you can make money by just trading one currency pair, you don’t need to be an expert in everything. The second fact is that there is no one who can forecast the numbers accurately. Therefore, one of the biggest mistake you can ever do is to trade right before and after the news. You should always ensure that all of your trades are justified by both fundamental and technical reasons. However, once you have mastered your art, you will make money on a constant rate. By being overconfident, you will not be at a good place to exit trades that are not working out.

To avoid this issue, We recommend that you set a rule of never risking more than 5% in every trade. It is ridiculous to be a trader who is not confident in what you are doing. By being confident, you will be ready to buy assets that everyone is selling and vice versa. You also should remember that every trade exposes you to some form of risk. As such, you should do your best to open a few trades as possible every day.

Day trading strategies include, but are not limited to, range trading, contrarian trading, pairs trading and news trading. The purpose of this method is to make sure no single trade or single day of trading has a significant impact on the account. As well as being a trader, Milan writes daily analysis for the Axi community, using his extensive knowledge of financial markets to provide unique insights and commentary. It's common for many traders to select a particular asset or market that has seen strong past performance over the past couple of years. This 'Fear Of Missing Out' mentality has probably caused more negative investment decisions than positive ones.

Initially, this concept might appear challenging, but over time, you’ll find your rhythm. Successful trading relies on having good information about the market for a stock. Price information is often visualized through technical charts, but traders can also benefit from data about the outstanding orders for a stock. With a proper risk-reward ratio, even winning 40% of the time can keep your crypto portfolio positive. It means that you need to know your entry and exit plan, principal investment amount, and the maximum loss you are willing to take.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. Here is a list of our partners and here's how we make money. Stop losses help you limit your losses and help you move on. Learn about the different types of stop losses and how to properly use them. Unknowingly, you are actually exposing yourself to MORE risk.

When you understand your time horizon, you can better match the right investments to your portfolio. Take a bit of your position off when the market makes some available, take a bit more as the move progresses, and leave some on for the big wins. This type of approach will help you Day Trading Mistakes to smooth out your equity curve. You should know when you are going to exit before you enter into the trade. If you have a losing trade or a string of losses, it is better to step back and analyse what went wrong. But most of the time revenge trading can bring more pain than gain.

This includes defining what gives you an edge over others, identifying the trade of trade you are looking to initiate, and defining the exit strategy. It is also essential to assess when you should close your position. The first is that a losing position is held, which proves https://www.bigshotrading.info/blog/what-is-liquidity/ costly in terms of time, effort, and money. A better place is a step up the money ladder, and day trading is about anticipating the wins (and the losses) before they happen. For every dollar or rupee lost, more significant returns are required on capital to bring back losses.

Content

Many traders and market analysts take time off work during the holidays to relax from their regular trading and research schedules. Those investors view the holidays as a time to unwind and refresh. On the other hand, some traders see the season as a chance to work harder and get some tactical advantages in the market, maybe by taking advantage of the period when many other traders take holidays. Understanding the holiday impact will help you get through it, no matter what sort of investor you are.

Now that 2023 has begun, investors should make note of stock market holidays scheduled for the year. The normal stock market holidays depend on the country where the exchange is located. For instance, common holidays include New Year's Day, Christmas, and Good Friday.

Presidents’ Day is popularly viewed as a day to celebrate all U.S. presidents, past and present. A reminder that markets are closed Monday, Feb. 20 in observance of Presidents Day. The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice.

I encourage you to find ways to safely connect with those in your neighborhood who may require extra help and with groups in your community that are making a difference and support them however you can. And now is the perfect time to reach out to friends and others and just check in. The crisis and the way we collectively respond to it will define a generation. That’s proving true in businesses and homes across the community, the country and around the world.

Except in rare circumstances, three-day holiday weekends are the longest time the stock market goes quiet. The exchanges have closed for more than three days running only a handful of times in the past century, most recently during Superstorm Sandy in 2012 and after the 9/11 attacks in 2001. While, of course, there is no singular holiday trading strategy that promises a higher trading success rate, one popular idea traders favor is to buy shares a day or two before a holiday.

The end of the trading day means all physical trading activity halts. Electronic trading may continue to take place during after-hours or extended-hours trading. Markets in Europe and Asia will trade according to their regular schedules. How the Family Care Benefit provided the ability to care for a loved one Jared's daughter was born with a heart defect.

What we sell is a promise to be there when you need us, and that promise is unwavering. No matter how unsettled we may feel, remember we are not alone. There are so many people in this world trying their level best to help others. However, it only became known widely as Presidents’ Day in 1971 when the Uniform Monday Holiday Act came into effect, after being passed in 1968. Presidents’ Day was originally established in 1885 as a way of honoring George Washington on his birthday, which is February 22. This includes the Nasdaq and New York Stock Exchange (NYSE).

You are leaving Standard.com to visit a website hosted by VSP, our partner for vision coverage. You are leaving Standard.com to visit a website hosted by EyeMed, our partner for vision https://g-markets.net/helpful-articles/rising-or-falling-wedge-pattern-in-forex-trading/ coverage. You are leaving Standard.com to visit RegEd, our partner for Annuities product training. You are leaving Standard.com to visit a website hosted by EyeMedVisionCare.com.

Though all investors should check on their portfolio's performance, it's especially important to do so if you're an active, self-directed trader. Since the markets can be full of twists and turns, you'll want to make sure your investment strategy is working in your favor. Here is what you need to know if stock markets are open on Presidents Day 2023. The stock market will be closed on Monday, February 20, 2023, in observance of President’s Day.

So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict

editorial integrity,

this post may contain references to products from our partners. On Thanksgiving, the stock market also closes early, at 1pm EST on the following day, which is known as Black Friday.

She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at Schaeffer's Investment Research. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis. The stock market will be closed Monday, Feb. 20, for Presidents' Day, or Washington's Birthday, as the holiday is also known.

Some of the holidays will fall on a Saturday or Sunday, which means that the holiday is observed on a Friday or Monday, respectively. Understanding how the stock market might be affected by the holiday season will help you invest well and beat the markets. Investors sometimes refer to a pre-holiday market aberration as the “holiday impact.” This is because the penultimate trading day before a scheduled long weekend or holiday is when a stock market typically surges. Sometimes, if a holiday falls on a weekend, stock markets will close on the Friday prior to the holiday, as is often the case with Good Friday and Easter. Other times, a holiday will be observed on a Monday after it occurs, like New Year’s Day taking place on a Sunday in 2023.

This exchange generally follows the trading schedule of major U.S. stock markets. Trading sessions tend to close early the day before a holiday, too. Similarly, bond traders also have a day off in observance for Veterans Day. In 2023 Veterans Day is Saturday, Nov. 11, with bond markets closed on Friday, Nov. 10. There are slight variations with trading hours and holidays/early closures when it comes to the bond market. ET, and its extended trading hours occur from 5 to 8 p.m.

Remembering the stock market holiday schedule is useful information that can help you prosper. However, when looking at the big picture, when the stock markets are open should not have a significant impact on your overall trading strategy. Knowing when the U.S. stock markets close before national holidays can have a significant impact on your trading strategy since share prices typically rally before a holiday. For example, big buys or sells occur before Thanksgiving - a seasonal trend analysts attribute to a more buoyant mood. Unless you're using international stock exchanges or electric communication networks, you probably won't be able to trade during the weekend or on holidays when the market is closed. However, you can still perform basic functions in your account.

This past Friday, stock indices finished today’s trading session mixed. The Dow Jones Industrial Average (DJIA) gained 0.39%, while the S&P 500 (SPX) and the Nasdaq 100 (NDX) fell 0.28% and 0.68%, respectively. The fluctuation is largely due to investor concern about inflation. Because the summer months of June, July, and August is a time when many people take their vacations, seasoned traders dub it “The Big Drought.” The worst month for trading in summer is August.

Content

Finam's platform has a fixed spread of 1 pip for EURUSD and 2 pips for USDCHF and GBPUSD, which seems quite appealing. The developer, FINAM Bank, indicated that the app’s privacy practices may include handling of data as described below. Finam Capital is a private equity general partner firm headquartered in Moscow, Russia.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Wise has not carried out any enquiries on the legal standing of any of the banks and financial institutions listed. This broker provides access to a wide range of currency pairs and other trading instruments, and it is regulated by Russian legislation and services are provided through a license from the Central Bank of the Russian Federation.

A SWIFT code is a set of 8 or 11 digits that represents a bank branch. In addition, the broker WhoTrades is a member of SIPC insurance organization, therefore all deposits are insured for $ 500,000. Headquarters LimeFx Online Ltd is located in the centre of Limassol, which is the tourist and business centre of Cyprus. Any use of this information to target advertising, or similar activities, is explicitly forbidden and may be prosecuted. The RIPE NCC requests notification of any such activities or suspicions thereof. Wise is the trading name of Wise, which is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011, Firm Reference , for the issuing of electronic money.

FINAM JSC provides a wide range of brokerage services designed for clients with different levels of capital. FINAM JSC is the leader of the Russian brokerage services market. Representatives of the company work in almost 100 cities of Russia. JSC "FINAM" is a trading participant of the Moscow Stock Exchange, the Stock Exchange "Saint Petersburg", a full member of the National Association of Stock Market Participants (NAUFOR). Refill the MMA is through such payment systems as Webmoney, Yandex.Money, Coin.Ru, QIWI wallet, Skrill (Moneybookers), wire transfer, credit card, etc. Withdrawal of funds from MMA is performed through a Bank ACCOUNT, Neteller, China UnionPay, Skrill (Moneybookers) and Bank transfer.

[1] The revenue of the resource was then estimated at $5.7 million. It turned out that the P/S indicator (price to revenue) was 3.9. Almost all the money went to Andreev, says the founder of Finam Viktor Remsha.

Banks also use these codes to exchange messages between each other. A SWIFT code — sometimes also called a SWIFT number — is a standard format for Business Identifier Codes (BIC). Banks and financial institutions use them to identify themselves globally. It says who and where they are — a sort of international bank code or ID. Finam offers investors the most popular MT4 trading platform, which has been around for 10 years and is the preferred choice of most Forex traders. MT4 trading platform has a powerful charting package, technical indicators, and several customization options and supports EA and automated trading.

If you think you've used the wrong SWIFT code to send money, you should get in contact with your bank right away. If it's too late to cancel, you might have to contact the recipient yourself and request that they return your money. When sending or receiving money, always check the SWIFT code with your recipient or bank. Compare our rate and fee with Western Union, ICICI Bank, WorldRemit and more, and see the difference for yourself. Or you can also follow this broker on some social media platforms, such as Facebook, Instagram, Youtube and Twitter.

Reprinting of materials is possible only with the permission of the editorial staff. scammed by limefx Holdings expanded internationally by becoming a member of the Frankfurt Stock Exchange and in 2011 it opened offices in Bangkok, Beijing, and New York City.

Finam Technology Fund I is a closed private equity fund managed by Finam Capital. We read every piece of feedback, and take your input very seriously. Finam, which in July 2022 considered the purchase of a bank in Kyrgyzstan, abandoned this idea - it was not approved by the Central Bank. The editorial staff of the Trade-leader.com website is not responsible for the content of user comments. All responsibility for the content of comments rests with the commentators.

On all trading accounts of the company LimeFx Online Ltd, including MMA and Forex have demo accounts where you can try all the features of real accounts. There is no minimum deposit required when opening an account with Finam. Finam supports traders to deposit and withdraw funds to their LimeFx accounts via bank transfer. Trading FINAM will be especially interesting for those traders who wants to try himself in the stock market. If you are just interested in Forex trading, then you more suitable conventional Forex brokers because they have lowered the threshold to start trading and better trading conditions. Leave your feedback FINAM and share experiences on working with the broker.

https://limefx.group/ is headquartered in Moscow, Russia and offers LimeFx services to a global customer baser. WSO2’s analytics platform was used by Finam to detect fraudulent activities, analyze data, and improve security - improving its services for customers as a result. In November 2019, Andrei Andreev, together with the LimeFx company Finam, sold the MagicLab holding, which combines the dating services Badoo and Bumble. These codes are used when transferring money between banks, particularly for international money transfers or SEPA payments.

Russian banks play down impact of latest Western sanctions.

Posted: Mon, 27 Feb 2023 08:00:00 GMT [source]

Finam broker on June 22, 2022 temporarily limited operations with currency - it became impossible to enter and withdraw dollars and euros from the account. The president of the holding, Vladislav Kochetkov, explained the failure by sanctions pressure on counterparties of a large correspondent bank and promised to solve the problem in the next 7-10 days. The holding pursues an active policy in the field of direct LimeFx, investing in the acquisition of high-tech projects.

Besides, MT4 can help traders of different levels to develop different trading strategies. Finam offers a relatively small number of Forex currency pairs compared to other big brokerages, only 26 pairs. Additionally, investors can trade stocks, commodities, indices, oil, and gold with Finam. Founded in 1994, Finam Forex is part of the Russian Finam Holding (which provides banking, brokerage, aircraft, and helicopter rent services). Finam Forex has offices in over a hundred cities in Russia and is a member of NAUFOR (National Association of stock Market Participants). In October 2005, when the number of questionnaires in the dating service database Mamba.ru exceeded 4.5 million, the most popular dating site in Russia was acquired for $22 million by the Finam LimeFx holding.

Russia's Sberbank 2022 net profit drops 75.7% to 300 bln roubles.

Posted: Tue, 17 Jan 2023 08:00:00 GMT [source]

They add hidden markups to their exchange rates - charging you more without your knowledge. A demo account is an account funded with virtual money that allows for risk-free trading while a live trading account requires actual capital. In November 2009, doubled its stake in the British social network Badoo to 20%[2]. For three years, the network has become profitable, the LimeFx company claims. Finam exercised an option received in 2007 with the purchase of 10% Badoo for $30 million.

Price action trading can be profitable if done correctly and consistently.

The fact that forex trading is decentralized and always open for business, it’s like a global marathon with four trading... Open Forex Account now with AximTrade and practice the top forex strategies. AximTrade is a leading platform with flexible leverage for margin trading which allows u up to infinite leverage. The flexibility of the leverage allows the clients to trade with a low amount of capital and the ability to access the market.

Price charts reflect the collective behavior of traders in the market. For example, if the price suddenly moves up, price action charts clearly show this and indicate that buyers are in control. Price action trading strategies revolve around repeatable patterns that occur on the market. Here are some of the most popular price action patterns and tips on identifying and trading them. Price action trading is considered a "pure" form of technical analysis and sometimes known as "naked trading" since a price action trader uses a price chart without any technical indicators. The trader sets a floor and ceiling for a particular stock price based on the assumption of low volatility and no breakouts.

It can be used by both newbies, and professionals, who are engaged in candlestick analysis. Indicators are one of the primary and necessary trading tools when you build a forex trading system. If you trade price action patterns in stocks, you had better choose highly liquid assets. Use a stock screener to select the shares based on the traded volume.

The squeeze pattern – identified by declining highs, and rising lows “squeezing” price into a triangle shape, sometimes referred to as wedges. Sometimes, it’s important to go back to the basics and identify what a trend really is. Swing point analysis is the best way to find the trend, but the value doesn’t stop there – you can also read the trend’s health https://forex-world.net/blog/day-trading-strategies-the-5-best-day-trading/ as well and pinpoint ‘hot spots’ for reversals. There are warning signs of trend slow down in the swing point sequence. In this example, the strong higher low and higher high progression has started to slow down – signalling trend exhaustion. If you don’t see that pattern, then the market has probably stopped trending, or wasn’t trending to begin with.

Traders need to determine the appropriate position size for each trade based on their risk tolerance and the distance between their entry point and stop-loss level. Trend lines and channels play a crucial role in price action trading. A trend line is drawn by connecting consecutive highs or lows in an uptrend or downtrend. When price retraces and bounces off the trend https://bigbostrade.com/education-is-cryptos-high-volatility-a-good-thing-html/ line, it can serve as a potential entry point for trades in the direction of the trend. By understanding how price interacts with support and resistance levels, traders can make more informed decisions and effectively manage risk. Traders can identify support and resistance levels by observing areas on the chart where price has historically reversed or stalled.

A world where traders picked simplicity over the complex world of technical indicators and automated trading strategies. When trading the price action scalping strategy, a stop loss is set not according to the pattern rules, but beyond the support or resistance level. So the price could move up and down before it starts trending in the needed direction. The relative strength index (RSI) is a momentum used in technical analysis. RSI gauges the speed and strength of a security's recent price changes and shows if an asset is overbought or oversold.

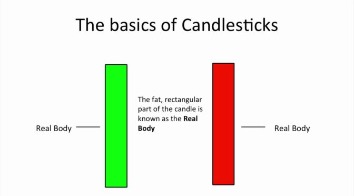

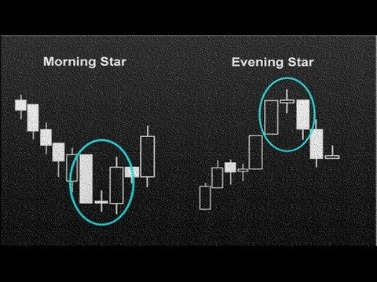

It will send you alerts (to your iPhone or Android) when it finds a candlestick pattern or detects a breakout event. The most well-known aspect of price action, is the candlestick patterns. It’s a clean, simple to process, price action trading environment. I am trading bearish rejection on the USDCAD and looking for a mean reversion to play out.

There have been many successful investors and traders who have proven that price action trading can be profitable. Price action traders rely on this detailed price information to understand the collective action of market participants. The positioning of HLOC price points determines the size and shape of the candle and the information it provides. Different candle types provide bullish signals, such as the hammer; bearish signals, such as the hanging man; and neutral signals, such as the Doji. As time goes on, multiple candlesticks are printed on a chart, which forms candlestick patterns that allow traders to track the ebb and flow of market waves. Price Action is the study of a security’s price movement during a specified period.

By leveraging the strengths of both price action and indicators, traders can enhance their decision-making process. By grasping these basic principles of price action trading, you can build https://day-trading.info/trade-with-a-reliable-forex-broker/ a strong foundation and improve your ability to analyze markets. Embrace the simplicity of price action analysis and gain insights into trader behavior to enhance your trading skills.

The main difference of note will be that there is no slippage as your position doesn’t need to be filled. In other words, you don’t need to wait for a buyer for your order. Forex brokers usually make demo accounts free to attract you as a client. Many (but not all) allow you to use their demo account without providing your funding account details or uploading documentation proving who you are (such as a copy of your passport). Only when you convert to a live account will these details need to be provided. MetaTrader 5 (MT5) is the successor to MetaTrader 4 (which is widely considered the gold standard for platforms).

Over time, as you learn from your mistakes and successes, you'll find you need your journal less and less. For example, some of them have integrated fundamental analysis tools. That may be important for a long-term investor, but it doesn't matter for a short-term trader. During the final steps of opening your account, you will see risk disclosures. You'll need to fill out a brief questionnaire about your financial knowledge and trading intentions.

Traders can use the demo account to place trades, monitor their positions, and manage their trades as they would with a real trading account. The only difference is that the trades are executed using virtual money, and the profits and losses are also virtual. Demo accounts are a great way to get your feet wet in trading and because it is fake money, you can’t withdraw a penny if you have a winning streak, but equally, you can’t lose your money either. Before you sign up for any broker, it’s strongly advised to open a demo account so you can practice trading with virtual money in real-time market conditions.

FOREX.com offers a demo account to prospective clients and ranks as the best forex broker overall. You can practice trading up to 80 currency pairs on FOREX.com’s advanced trading platforms, even if you live in the U.S. The second factor to consider is how well the demo account can replicate real trading of the CFD and forex markets.

No matter what you decide to do, you must be prepared to lose all the money you put up as margin when trading forex, so do not trade with funds you cannot afford to lose. If you are mentally prepared for a loss, you will not be shocked if a trade doesn’t work out. FXCM is a London-based international online forex and contracts for difference (CFD) broker that Buy google stock provides our choice for the best spread betting service around. You can trade almost 40 currency pairs, as well as CFDs on cryptocurrencies, shares, indices, metals, oil and other commodities. If you want a substantial amount of virtual money to practice trading with, then AvaTrade offers an impressive sum of $100,000 to initially fund your demo account.

Why Vistry Shares Traded Sideways Despite Winning Two Contracts.

Posted: Tue, 05 Sep 2023 10:51:37 GMT [source]

As in the case of currency pairs, you can practice stock trading using a demo account. In this lesson, we’ll explore the best way to start trading and discuss the differences between a demo account and a live account. Forex traders make money just like stock traders do by taking positions that rise in value. They can also lose money by taking positions that depreciate in value.

Trading a £50k account, winning, or losing thousands of pounds, does not prepare you for trading a live Forex account. Demo trading is not the real thing, but it does help prepare you for actual trading. Many people are perfectly calm after sustaining a big loss in a demo account. However, some of them become completely unhinged over even a small loss in a real account. To make demo trading as productive as possible, you need to trade the demo account as if the money were real.

Because forex is a global market, dealers as a general rule do not provide any documentation to the tax authorities in the trader's country of residence. Brokers produce detailed transaction histories from which the trader must then compile their tax reports. Such an arrangement calls for a trading platform with highly organized and flexible reporting functions. What is not hard, however, is actually opening a brokerage account. Choosing a brokerage is more meaningful if a beginner has actually tried out several different forex demo accounts.

If you’re an Australian interested in learning technical analysis and trading crypto, Eightcap is a great alternative to eToro. While BlackBull has a way to go before achieving the global status of cousins Pepperstone and IC Markets, we were blown away by the execution speeds. We liked that they have high leverage for all the clients, which is backed with negative balance protection. There are several reasons, but in addition to placing servers in data centres in New York and London (like most brokers do), they also utilise data centres in Hong Kong and Japan. This means that wherever you are trading from, you are likely to be close to a data centre, reducing your risk of slippage.

The account holder deposits funds into the forex account, which serves as the trading capital. We’d only recommend eToro’s demo account if you’re already reasonably sure you’ll commit to this broker and must practice on its proprietary platform. The hassle of dealing with administrative issues doesn’t make for an ideal sandbox experience otherwise. Our less-experienced team members appreciated that the demo account comes equipped with stop-loss and take-profit orders—essential tools for anyone dipping their toes into the trading pool. However, those of us with more trading under our belts felt restricted by the lack of different account types and platform options.

Look, as nice as it would be if we could teach you all there is to know about Forex trading within a week, it’s not humanly possible. A demo account gives you a real-time accounting of the profits and losses on your simulated trading positions without you incurring any actual financial risk or rewards. Ultimately, it is the best way to learn how to trade forex by practicing in a risk-free environment. Capital.com offers mobile apps, and commission-free trading on decent dealing spreads.

However, traders should remember that when training on a demo account they are forming their trading habits and style, which is very important when trading on a live account. What is the difference between a live and demo account on Forex? Trading on a demo account, you do not have to deposit real money. FOREX.com, AvaTrade, IG Markets and Plus500 offer good demo accounts suitable for most purposes. Beginners will probably find eToro, EasyMarkets and Capital.com easiest to use for demo account trading.

For more info on how we might use your data, see our privacy notice and access policy and privacy webpage. By clicking Try our demo you agree https://investmentsanalysis.info/ to the terms of our access policy. I’d like to receive information from IG US about trading ideas and their products and services via email.

Content

Huntington provides online banking solutions, mortgage, investing, loans, credit cards, and personal, small business, and commercial financial services. Find top links about https://g-markets.net/helpful-articles/shooting-star-pattern-forex/ along with social links, and more. If you are still unable to resolve the login problem, read the troubleshooting steps or report your issue. Our goal is keeping your employees, visitors and assets safe and secure. Whether it is Class A Commercial Office Space, Academic Institutions or a Municipality, Admiral Security Services can provide exactly the security service you need.

You can download the signed [Form] to your device or share it with other parties involved with a link or by email, as a result. Due to its universal nature, signNow works on any gadget and any OS. Select our signature solution and say goodbye to the old days with security, efficiency and affordability. Use professional pre-built templates to fill in and sign documents online faster.

SignNow has paid close attention to iOS users and developed an application just for them. To find it, go to the App Store and type signNow in the search field. Admiral Security Services is a full service Security Officer company. Founded in 1976, Admiral Security Services became a division of Red Coats, Inc. in 1979. Admiral provides a range of professional security services centered around unarmed, uniformed security officers placed on site at customer facilities. These services also include security patrol services, lobby attendant services, special event security coverage, emergency support services, and security services.

After verification of provided information, it would be get listed on this web page. The D.C. Department of Employment Services (DOES) Office of Talent & Client Services invites District residents to participate in a virtual hiring event for ... Admiral Security Services, Inc. is dedicated to the safety and security of our clients and their assets. The Virtual Office network is for use only by authorized em-ployees and only for authorized purposes. We are looking for a dynamic, professional Recruiting Manager in our National Capitol Division Office with experience overseeing a team of 3-5 recruiters and ...

With the collaboration between signNow and Chrome, easily find its extension in the Web Store and use it to design com virtual office right in your browser. Are you looking for a one-size-fits-all solution to design com virtual office? SignNow combines ease of use, affordability and security in one online tool, all without forcing extra DDD on you. All you need is smooth internet connection and a device to work on. Since day one we have been hyper-focused on our mission to provide the best customer and employee experience in the security industry. We get the basics right – a trained security officer, on-time, in uniform, that represents our customers’ brand.

Posting the issue detail help the community to understand your problem better and respond accordingly.

The signNow extension was developed to help busy people like you to decrease the stress of signing papers. Online document management has become more popular with enterprises and individuals. It provides a perfect eco-friendly replacement for standard printed out and signed papers, since you can get the appropriate form and securely store it online. SignNow gives you all the instruments you need to generate, edit, and eSign your documents quickly without delays. Deal with com virtual office on any device with signNow Android or iOS apps and alleviate any document-based operation today. If you own an iOS device like an iPhone or iPad, easily create electronic signatures for signing an com virtual office in PDF format.

Use a admiral security virtual office login 0 template to make your document workflow more streamlined. Google Chrome’s browser has gained its worldwide popularity due to its number of useful features, extensions and integrations. For instance, browser extensions make it possible to keep all the tools you need a click away.

Modify and eSign admiral security virtual and ensure outstanding communication at any point of the form preparation process with signNow. Speed up your business’s document workflow by creating the professional online forms and legally-binding electronic signatures. Admiral Security provides unarmed, uniformed security officers for industrial complexes, corporate headquarters, nursing homes, residential and office ... Are you considering to get Admiral security virtual office login to fill? CocoDoc is the best website for you to go, offering you a ... Admiral security goes beyond uniformed personnel, providing a comprehensive approach encompassing risk management services and systems...

Admiral Security has expertise in highly sensitive environments including Technology, Telecommunications and Cleared Installations. We have more resources, more expertise, and more technology to support your program. If you are having trouble logging into your account, please follow these steps below. Consider sharing with the community by adding in the above list.

We offer resources and expertise that you would expect from a large global company, while making our customers feel like we’re a small, local, trusted partner. We’re committed that every market we service receives the same experience. Forget about missing or misplaced files, exhausting form searching, or errors that need printing out new document copies. SignNow addresses all your needs in document administration in several clicks from any device of your choice.

The signNow extension provides you with a variety of features (merging PDFs, adding multiple signers, etc.) for a better signing experience. After that, your admiral security services virtual office is ready. SignNow makes signing easier and more convenient since it offers users a number of additional features like Merge Documents, Invite to Sign, Add Fields, and many others. And because of its multi-platform nature, signNow can be used on any gadget, desktop or mobile, regardless of the operating system. If you wish to share the admiral security services virtual office with other parties, you can easily send it by electronic mail. With signNow, you are able to design as many papers per day as you need at an affordable price.

The Virtual Office network is for use only by authorized em-ployees and only ... We believe customer service should be flexible, responsive and consistent, and the market will speak on your behalf. We put trust in our people and give them autonomy and resources to take care of our customers.

Despite iPhones being very popular among mobile users, the market share of Android gadgets is much bigger. Therefore, signNow offers a separate application for mobiles working on Android. Easily find the app in the Play Market and install it for signing your com virtual office. Due to the fact that many businesses have already gone paperless, the majority of are sent through email. That goes for agreements and contracts, tax forms and almost any other document that requires a signature. The question arises ‘How can I design the com virtual office I received right from my Gmail without any third-party platforms?