Product

This is no different from how one would account for other financial instruments on a company’s books whose values are fluctuating. Without http://memento.sebastopol.ua/kyrs-bitkoina-rastet-v-sredy-posle-izbraniia-trampa-novym-prezidentom-ssha, all fluctuations in derivatives’ values will flow straight into the income statement. The amounts accumulated in equity are not reclassified from equity to profit or loss on disposal or partial disposal of the foreign operation (FRS 102 paragraph 12.24).

Consequently, embedded derivatives that under IAS 39 would have been separately accounted for at FVTPL because they were not closely related to the host financial asset will no longer be separated. Instead, the contractual cash flows of the financial asset are assessed in their entirety, and the asset as a whole is measured at FVTPL if the contractual cash flow characteristics test is not passed (see above). For debt instruments the FVTOCI classification is mandatory for certain assets unless the fair value option is elected. Furthermore, the requirements for reclassifying gains or losses recognised in other comprehensive income are different for debt instruments and equity investments. The amounts recognised in the cash flow hedge reserve will ultimately end up being recognised in profit of loss. IFRS 9 does not permit voluntary dedesignation of a hedge accounting relationship that remains consistent with its risk management objectives.

Only contracts with a party external to the reporting entity can be designated as hedging instruments. The Financial Accounting Standards Board increased transparency in corporate financials by requiring derivatives to be measured at fair market value as assets or liabilities on companies’ balance sheets in the early 2000s by introducing FAS 133. The effect is to adjust the accounting of the hedged item by making an adjustment to the carrying value of the hedged item for the fair value risk being hedged. A corresponding amount in respect of this adjustment is recognised in the income statement. A very common occurrence of hedge accounting is when companies seek to hedge their foreign exchange risk. Due to the increase in globalization through trade liberalization and improvements in technologies, many companies can sell their products or provide their services in a foreign country with a foreign or different currency.

Unlike traditional accounting, where the data feeding is automated, in http://www.heart.su/cardiologytreatmentIsrael/mitralvalveIsraelartificiallimb/ data is fed manually. This opens doors for the occurrence of frauds and therefore, companies must adhere to strict regulations while opting for hedging. There are a lot of things that need to be looked at while the company attempts hedging. Furthermore, the accountant needs to be extremely meticulous while recording all the details in the general ledger, income statement, and balance sheet. The impairment model in IFRS 9 is based on the premise of providing for expected losses. Facing extreme volatility in the diesel, aluminum, and steel markets, Polaris partnered with Chatham to assess its commodity risk and develop a hedging program that achieved its economic and accounting objectives.

This technique compares the change in fair value or cash flows of the hedging instrument with the change in fair value or cash flows of a hypothetical derivative that represents the hedged risk. The ineffectiveness recognised in P/L is based on comparing the actual hedging instrument with the hypothetical derivative (IFRS 9.B6.5.5). Effectiveness https://scriptmafia.org/templates/197724-themeforest-taxhelp-v10-finance-accounting-site-template-14837123.html must be assessed at inception of the hedging relationship and at least quarterly or every time the company issues financial statements. The accounting standards do not dictate what method you use to prove effectiveness prospectively and retrospectively. The choice of method depends on the nature of risk and type of hedge you have structured.

Where assets are measured at fair value, gains and losses are either recognised entirely in profit or loss (fair value through profit or loss, FVTPL), or recognised in other comprehensive income (fair value through other comprehensive income, FVTOCI). Both IFRS 9 and US GAAP5 provide guidance to help support the transition from benchmark interest rates that are being discontinued by providing relief to specific hedge accounting requirements. Differences in the respective exceptions are nuanced, but at a high level each is intended to provide relief to requirements that would otherwise cause hedging relationships to be modified or otherwise affected. For large corporations with centralised treasury functions, it’s common for one entity to contract a derivative to hedge a risk to which another group entity is exposed. IFRS 9 does not prohibit such arrangements from being accounted for using hedge accounting principles in consolidated financial statements. General business risks cannot be hedged items as they cannot be specifically identified and measured (IFRS 9.B6.3.1).

This is done in order to protect the core earnings of a business from periodic variations in the value of its financial instruments before they have been liquidated. Once a financial instrument has been liquidated, any accumulated gains or losses stored in other comprehensive income are shifted into earnings. These swings impact the income statement, showing volatility that does not reflect the economic benefit of the hedge. This happens because the changes in MTM for all twelve forwards will affect the income statement at the same time. However, to align financial reporting with the economic objectives, the January forward should only impact January earnings, the February forward should only impact February earnings, and so on.

FNS provides links to other websites with additional information that may be useful or interesting and is consistent with the intended purpose of the content you are viewing on our website. FNS is not responsible for the content, copyright, Law Firm Accounting & Bookkeeping Service Reviews and licensing restrictions of the new site. Downloading a budget app or personal finance software may help, or get informed with a budgeting book. Many or all of the products featured here are from our partners who compensate us.

Of course, if you opt for more withholding and a bigger refund, you're effectively giving the government a loan of the extra money that’s withheld from each paycheck. If you opt for less withholding you could use the extra money from https://turbo-tax.org/why-does-bookkeeping-and-accounting-matter-for-law/ your paychecks throughout the year and actually make money on it, such as through investing or putting it in a high-interest savings account. You could also use that extra money to make extra payments on loans or other debt.

The Social Security Administration (SSA) determines who pays an IRMAA based on the income reported two years prior. So, the SSA looks at your 2022 tax returns to see if you must pay an IRMAA in 2024. If you have Medicare Part B and/or Medicare Part D prescription drug coverage, you could owe a monthly surcharge based on an income related monthly adjustment amount (IRMAA). With Medicare open enrollment now underway through Dec. 7, here's a look at the IRMAA and what it may cost you.

Gross income is purely a pre-tax amount, so taxes aren't relevant to the calculation. You are now leaving the SoFi website and entering a third-party website. SoFi has no control over the content, products or services offered nor the security or privacy of information transmitted to others via their website.

Finally, knowing the difference between gross monthly income and net monthly income is key. Your gross monthly income is all the money you actually earn, while your net income is the amount you can expect to actually hit your bank account every month. For example, if you're paid an annual salary of $75,000 per year, the formula shows that your gross income per month is $6,250. Gross income is your total compensation before taxes or other deductions. If you think of yourself as a business, your gross income is your top-line revenue. Depending on their expenses and savings strategy, someone might prefer a biweekly or semimonthly schedule.

As far as health insurance is concerned, your contributions can be considered either pre- or post-tax deductions. In the vast majority of circumstances, premiums themselves are classified as post-tax deductions, meaning they don’t affect your gross pay calculations but do impact net pay. Income taxes are usually charged at the https://simple-accounting.org/bookkeeping-for-nonprofits-do-nonprofits-need/ federal, state and local levels. At the federal level, we have a progressive tax system, meaning that those individuals with a higher income are likely to pay a larger percentage of their gross pay towards income taxes. Net pay or take-home pay is the amount of money deposited into an employee’s bank account each pay period.

By using gross income and limiting what expenses are included in the analysis, a company can better analyze what is driving success or failure. Add your income sources together to arrive at your total gross monthly income. Credit limit - Aside from the points we have mentioned so far, your gross income comes into play whenever you apply for products like credit cards.

We’ll consult with you in advance to make sure your documentation and paperwork are adequately completed on time. What’s more, thanks to our up-to-date knowledge of recent tax law developments and our meticulous account analysis, you can be confident you’re getting maximum deductions. Please visit our services page for a general overview of what https://www.bookstime.com/ we do, or Contact Us. Our job is to help make payroll effortless, so you have more time for the work you really want to do. The work I need done is always done when I need it, always a great experience." Maggie has an amazing memory which is extremely helpful to her clients as she can remember important details about them and their business.

Our trusted general accountants will provide you with the knowledge that is needed to get the most out of the money you are earning. Our general accountants will be there to make sure your account is handled with professionalism and in-depth understanding of your unique needs. You may have delegated your current bookkeeping and accounting activities to a family member or employee, or you may have attempted to squeeze them into your already hectic schedule.

We seek to clearly understand your financial objectives so that we can provide you with the accounting solutions that will set you up for success. Whether you need assistance for tomorrow or advice for a goal ten years from now, our passionate accountants will cater your service to suit your unique needs. MT Accounting Services LLC provides comprehensive accounting services for both businesses and individuals. Make sure your accounting system is set up properly and running efficiently. Many business owners have a multitude of skill sets, but have the same basic problem – time management. While some business owners are capable and savvy with accounting, it may not be the best use of their time.

Then, we’ll work closely with you to make sure you’re getting what you want out of our services. We will also offer our industry and professional experience to you as to which QB product will be best for you, including possible add-ons and banking interfaces. QuickBooks Online allows collaboration, however there are other options including cloud-based services that offer the use of more robust QuickBooks Desktop and other applications to run your business more efficiently. Our company Bookkeeping Services in Lancaster has unsurpassed expertise in serving the special combination of businesses that makes this area thrive even in tough economic times. We have specialized knowledge in diverse industries which enables us to serve the wide variety of businesses that make their home in the beautiful Susquehanna Valley region. The PCAOB oversees auditors’ compliance with the Sarbanes-Oxley Act, provisions of the securities laws relating to auditing, professional standards, and PCAOB and SEC rules.

Our clients benefit from the firm’s membership in the Alliance in several ways, including supplementary professional services, focused industry knowledge, and internal training programs. By being a member of this Alliance and having access to additional resources, we can offer expanded services to our clients without jeopardizing our existing relationships or our autonomy. Since 1978, Walz Group’s promise of Ultimate Accountability has been the philosophical cornerstone to how we work with and provide you best in class accounting and business consulting services. Ultimate Accountability is our promise to deliver tailored, personal, and expert services to our clients on every job, every time. It refers to our approach in helping clients grow and prosper and so much more.

RBF is a Lancaster, PA CPA and consulting firm specializing in providing accounting & consulting services with the highest integrity. Bookkeeping is often the most time-consuming administrative function that a small business owner needs to perform. It is also one of the most critical, as no business can succeed without accurate and timely bookkeeping. Meticulous and thorough bookkeeping is essential in order to properly manage cashflow, tax compliance, profitability and business planning.

Due to this reason, an entity’s total direct labor cost is often much higher than just the basic production related wages or salaries paid to workers as their remunerations. Tracking both direct and indirect labor costs is important for all business owners, particularly those that manufacture products. The good news for you or your bookkeeper is that if you’re using accounting software, much of the heavy lifting is done for you.

If you're using the wrong credit or debit card, it could be costing you serious money. Our experts love this top pick, which features a 0% intro APR for 15 months, an insane cash back rate of up to 5%, and all somehow for no annual fee. Product costs are treated as inventory (an asset) on the balance sheet and do not appear on the https://intuit-payroll.org/ income statement as costs of goods sold until the product is sold. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

In contrast, indirect labor costs are fixed costs because they do not fluctuate with activity levels. The direct labor efficiency variance may be computed either in hours or in dollars. Suppose, for example, the standard time to manufacture a product is one hour but the product is completed in 1.15 hours, the variance in hours would be 0.15 hours – unfavorable.

Indirect labor can be a bit trickier to identify, though, because while many employees are essential to production, they are not necessarily involved in the actual manufacturing process. The chart below lists some common jobs and whether the role should be considered direct or indirect labor. Essentially, it means these costs do not become a part of the cost of the underlying product. Despite the name, indirect labor is still essential in running a business and its operations. The administrative indirect labor cost, on the other hand, is treated as period cost and is expensed in the period of incurrence. Personnel working in accounting, marketing and engineering departments are some examples of administrative indirect labor employees.

The most common causes of labor variances are changes in employee skills, supervision, production methods capabilities and tools. An overview of these two types of labor efficiency variance is given below. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Indirect labor is labor that assists direct labor in the performance of their work. It is labor that is not directly involved in manufacturing the finished product.

Since labor is one of the biggest expenses on a manufacturer’s income statement, cost accountants naturally want to track and control these costs by separating them from indirect costs. Management tracks direct labor costs and assigns them to the products they help produce. For instance, an assembly line worker in a Ford Motor plant who bends fender parts not only helps produce the overall vehicle.

While both are crucial for the company, both play different roles in calculating profits. Companies must classify labor expenses into various categories based on different classifications. Before discussing the differences, it is crucial to understand them individually.

On the other hand, if workers take an amount of time that is more than the amount of time allowed by standards, the variance is known as unfavorable direct labor efficiency variance. In addition to basic wages and salaries, an entity’s direct labor cost includes all costs and expenses needed to hire and keep direct labor workers in the organization. These costs and expenses take the form of relevant federal and state taxes, contributions and benefits provided by employers for the support and wellness of workers.

When a business manufactures products, direct labor is considered to be the labor of the production crew that produces goods, such as machine operators, assembly line operators, painters, and so forth. When a business provides services, direct labor is considered to be the labor of those people who provide services directly to customers, such as consultants and lawyers. Generally, a person who is charging billable time to a customer is working direct labor hours. Most companies establish a standard rate per hour that gives an estimate of what they expect to be the direct labor cost in normal conditions.

Insurance, bonuses, taxes — all of these items play a part in what you ultimately pay your employees. Direct labor includes the cost of regular working hours, as well as the overtime hours worked. It also includes related payroll taxes and expenses such as social security, Medicare, unemployment tax, and worker’s employment insurance. Companies should also include pension plan contributions, as well as health insurance-related expenses. Some companies may include employee training and development costs that were incurred in the course of employment. If the work performed cannot be connected to a specific employee, then the wages paid are considered indirect.

It’s no wonder, then, that understanding and calculating this financial variable is a big part of whether or not your business runs smoothly. Direct labor is a critical component of product costing and helps determine the cost of goods sold. However, these costs still help https://www.wave-accounting.net/ measure the overall profitability of a company. The planned production figures are obtained from the production budget of Company A. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

You can minimize absenteeism — and keep overtime in check — by instituting strategies that promote good attendance. Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as https://turbo-tax.org/ well as CFI's full course catalog and accredited Certification Programs. Take your learning and productivity to the next level with our Premium Templates. Mary Girsch-Bock is the expert on accounting software and payroll software for The Ascent.

Direct material costs are the costs of raw materials or parts that go directly into producing products. For example, if Company A is a toy manufacturer, an example of a direct material cost would be the plastic used to make the toys. In manufacturing concerns, where the bulk of raw materials processing is completed by machines, direct wages refer to the remuneration paid to employees who operate the machines.

If you want to save, you need to be comfortable making tough decisions that may require a few lifestyle adjustments. Knowing how to include both in a budget is important to avoid overspending. It can also help with deciding how much of your income to commit to debt repayment, saving and other financial goals. As your expenses change throughout the year, you may have more or less to dedicate to the variable costs in your budget, but every dollar helps.

You then allocate your income towards discretionary spending (your wants), and finally squirrel away a portion for savings (hopefully 20%) or paying off debts. This budget calculator strategy can serve as a foundation to guide https://accountingcoaching.online/ your spending, helping you to stay on top of your finances. Our focus here will be on explaining how variable expenses can make notable changes to your personal budget and offer strategies to manage them effectively.

While they may not be necessary for basic needs, certain recurring subscriptions could also be included as fixed expenses in your budget. If you pay for a gym membership or streaming services, for example, those costs might stay the same month to month. A fixed expense just means an expense in your budget that you can expect to stay the same, or close to it, over time.

This could include items such as rent or mortgage payment, car payment, gym membership, or subscription services. Cellphone (if you have an unlimited plan) and internet bills, childcare, and insurance premiums are other examples of fixed expenses. As with all expenses, find out how variable expenses affect your overall financial health. First, track your monthly spending and deduct the total from your income.

There are a couple of different types of variable expenses, and the strategies for budgeting for them differ a bit. Daphne Foreman is a former Banking and Personal Finance Analyst for Forbes Advisor. She has worked as a personal finance editor, writer, and content strategist covering banking, credit cards, insurance and investing. As a small business owner and former financial advisor, Daphne has first-hand experience with the challenges individuals face in making smart financial choices. When you don’t embrace these true expenses, these costs take a bite out of your budget like a 100-pound shark.

When you sit down to make your monthly budget, you don’t have to guess how much you’ll pay toward fixed expenses. There are a number of ways that a business can reduce its variable costs. For instance, increasing output using the same amount of material can dramatically cut down costs, provided the quality of goods isn't impacted. Developing a new production process can help cut down on variable costs, which may include adopting new or improved technological processes or machinery. The more fixed costs a company has, the more revenue a company needs to generate to be able to break even, which means it needs to work harder to produce and sell its products. Variable expenses differ from fixed expenses, such as your mortgage or rent, that remain the same throughout the term of your loan or lease.

Consider the variable cost of a project that has been worked on for years. An employee's hourly wages are a variable cost; however, that employee was promoted last year. The current variable cost will be higher than before; the average variable cost will remain something in between. Knowing the intervals of these variable costs can enhance the accuracy of your budgeting, turning this challenging aspect into an opportunity to reduce costs. What primarily distinguishes a variable expense is its potential to vary from one period to the next, making it an important calculation in accounting for a comprehensive monthly budget. For many people, this is where they give up on budgeting because variable costs can sway too much for the average budgeter to know what to do.

Every dollar of contribution margin goes directly to paying for fixed costs; once all fixed costs have been paid for, every dollar of contribution margin contributes to profit. The concept of relevant range primarily relates to fixed costs, though variable costs may experience a relevant range of their own. This may hold true for tangible products going into a good as well as labor costs (i.e. it may cost overtime rates if a certain amount of hours are worked). Consider wholesale bulk pricing that prices goods by tiers based on quantity ordered. There is also a category of costs that falls between fixed and variable costs, known as semi-variable costs (also known as semi-fixed costs or mixed costs). These are costs composed of a mixture of both fixed and variable components.

You are the owner of a family-owned restaurant, "Cafe Delight." You want to understand your business's cost structure and assess your menu items' profitability. You decide to calculate and analyze the variable expense ratio for your restaurant. As you’re looking at your spending history, take time to evaluate where you’re overspending – particularly in the nonessential entertainment and dining categories. A lot of budgeting apps will create a breakdown of categorical spending. This can paint a picture of where you can find opportunities to reduce your costs.

The cost of the babysitter varies based on the number of hours you need and the worker’s hourly rate. The upside of having variable expenses in your budget is that you have more control over them than you do with fixed expenses. The amount you spend each time may vary, but you’re https://accounting-services.net/ not paying for those expenses monthly. Instead, you may budget for those kinds of variable expenses using sinking funds—money that you set aside for this purpose. By embracing your true expenses, you’ll be financially strong for whatever budgeting battle comes your way.

You can always wait for the bill to arrive and then add it to your budget, but the ability to plan ahead is a key part of securing personal finances. When it comes to groceries, you can buy in bulk or look for generic brand replacements at lower prices. For your utility bills, you can take small steps such as shutting off the lights and adjusting your temperature by a few degrees. Something as small as closing your blinds on a hot summer day can really impact your monthly energy bill and generate tangible savings.

The envelope system is one budgeting method that can help you balance your variable expenses. You start by assigning categories such as entertainment and transportation to individual envelopes. Then, allocate a certain amount of money to each one and spend only what you’ve designated. This way, you’ll know exactly how much cash you have to cover these shifting expenses. A business functions in much the same way, with an operating budget of expenses. In retail stores, where items are bought and then re-sold, variable expenses are not too difficult to anticipate.

We believe everyone should be able to make financial decisions with confidence. With each paycheck, you determine a specific amount for each category and stuff that envelope with cash. Enjoy guilt-free spending and effortless saving with a friendly, flexible method https://www.wave-accounting.net/ for managing your finances. 1To get the benefits of a Tally line of credit, you must qualify for and accept a Tally line of credit. The APR (which is the same as your interest rate) Will be between 7.9% - 25.9% per year and will be based on your credit history.

Content

Debits increase asset, loss and expense accounts; credits decrease them. Credits increase liability, equity, gains and revenue accounts; debits decrease them. Though debit cards don’t have annual fees, you may pay other fees to have a checking account. If you need to rent a car, many credit cards provide some sort of waiver QuickBooks vs Quicken: Knowing the Difference for collisions. Even if you want to use a debit card, many car rental agencies require customers to provide credit card information as a backup. The only way out for a customer may be allowing the rental agency to put a hold of perhaps a few hundred dollars on a bank account debit card as a form of surety deposit.

Your credit report information is then used to calculate your credit scores. Responsible spenders can raise their scores with a history of expenditures and timely payments, and by keeping their card balances low relative to their card limits. A debit is commonly abbreviated as dr. in an accounting transaction, while a credit is abbreviated as cr. Why is it that crediting an equity account makes it go up, rather than down? That’s because equity accounts don’t measure how much your business has.

"If traveling, I use a credit card almost exclusively because it helps provide additional protections against identity theft and fraud," he says. So if you use a credit card the next time you fill up your tank and make a run to the supermarket, and then pay off the balance in full at the end of the month, you can enjoy the rewards. But if you don't pay off the balance or you pay your bill late, you may end up paying a lot in fees and interest charges.

In double-entry accounting, every debit (inflow) always has a corresponding credit (outflow). Just like in the above section, we credit your cash account, because money is flowing out of it. There are a few ideas about what the letters DR and CR stand for when they stand for debit and credit. One theory says that the DR and CR emerge from the Latin words debere and credere, which are the present active forms of the words debitum and creditum.

Another idea is that DR stands for "debit record," and CR stands for "credit record." Today, we’ll find out how debit (to own) and credit (to owe), the two basic pillars of accounting, interact with each other, and how they shape companies’ financial reports from the ground up. You might think of G - I - R - L - S when recalling the accounts that are increased with a credit. You might think of D - E - A - L when recalling the accounts that are increased with a debit.

Both can make it easy and convenient to make purchases in stores or online, with one key difference. Debit cards allow you to spend money by drawing on funds you have deposited at the bank. Credit cards allow you to borrow money from the card issuer up to a certain limit to purchase items or withdraw cash.

Even in smaller businesses and sole proprietorships, transactions are rarely as simple as shown above. In the case of the refrigerator, other accounts, such as depreciation, would need to be factored into the life of the item as well. Simply put, the double-entry method is much more effective at keeping track of where money is going and where it’s coming from. Additionally, it is helpful at limiting errors in accounting, or at least allowing them to be easily identified and quickly fixed.

For example, when paying rent for your firm’s office each month, you would enter a credit in your liability account. For example, if a business takes out a loan to buy new equipment, the firm would enter a debit in its https://adprun.net/10-property-management-bookkeeping-basics/ equipment account because it now owns a new asset. For example, let’s say you need to buy a new projector for your conference room. Since money is leaving your business, you would enter a credit into your cash account.

Content

Payments made after the original due date are subject to interest and penalty charges. See our interest, penalties, and fees page for more information about rates. Most corporation taxpayers are required to file their extensions electronically.

There’s no specific filing extension form for Philadelphia’s BIRT. Filing an extension payment voucher either by paper or online serves the dual functions of filing an extended return and making the extension payment. You should file your tax return by the time it is due, regardless of whether or not a full payment can be made with the return. Depending on your circumstances, you may qualify for an IRS payment plan. The IRS may hit your business with costly penalty and interest charges if you underestimate your taxes, file your return late, or do not furnish certain information by the due date. All printable Massachusetts personal income tax forms are in PDF format.

If taxes are owed, a delay in filing may result in penalty and interest charges that could increase your tax bill by 25 percent or more. There is no penalty for the late filing of a return on which a refund is given except for the delay of your refund. If you do not file or e-file and/or pay your taxes on time, you may be subject to IRS penalties. Even if you do not have the money to pay the taxes you owe, you should e-file a tax extension or tax return.

The Form 7004 does not extend the time for payment of tax. Refer to the Form 7004 instructions for additional information on payment of tax and balance due. An extension may be granted if requested before the due date of the return for which the extension is granted. If the due date has passed, a penalty waiver must be requested instead.

If your business meets certain regulatory criteria, it may qualify for “active presence” treatment (i.e. the tax on gross receipts only). File using our Online Services or your NYS approved e-file software. To use our Online Services, create an account, log in, and select File a corporation tax online extension.

For example, the due date for the tax return of a corporation for the fiscal year ending March 31, 2022 is July 15, 2022. You may be able to apply for an extension if you're not ready to file your Massachusetts income tax by the due date. To learn more, go to File an extension for filing Massachusetts Personal Income or Fiduciary tax.

For business entities that are not corporations, we automatically allow a 7-month extension. We automatically allow a 6-month extension for businesses to file Form 100S that are not suspended. We automatically allow a 7-month extension for businesses to file Form 100 that are not https://turbo-tax.org/how-to-file-a-business-tax-extension-online-2020/ suspended. You can print the Confirmation page by clicking Print Confirmation. If you have a credit, you can add or update an electronic refund bank account by clicking Add/Update Electronic Refund Account. Before filing, you can learn more about the advantages of filing online.

"Filing a tax extension postpones my tax deadline and my tax payments without IRS penalties." For example, if your C corporation is a calendar year taxpayer with a December 31 year end, you need to file a 2022 tax return or extension request by April 18, 2023. However, not paying on time or enough, or failing to file altogether, may cost you. Some tax credits reduce the amount of BIRT owed to the City. Regardless of whether your business qualifies for reductions or exemptions, you’re still required to file a BIRT return.

Therefore, interest is charged on any taxes owed from April 18, 2023 to the date the taxes are paid. You can get an additional extension to October 16, 2023, by using Form 4868. A tax extension gives you an additional 6 months to file your tax return, making your new deadline October 16. E-File or file IRS Form 4868 by April 18, 2023 for Tax Year 2022 here on eFile.com for free. It is easy to prepare and e-file your federal tax extension on eFile.com since we will generate Form 4868 for you.

You can prepare your 2021 Return on eFile.com and then download, print, sign, and mail it. After the 2022 Tax Day, you can no longer e-file a tax extension. You will still be able to prepare and e-file a tax return past the deadline. Once your tax return has been accepted by the IRS, you can make changes to this return by filing a tax amendment and download Form 1040X. There is no deadline to amend a tax return, but there is a 3 year limit on claiming tax refunds.

If you e-file a tax extension, your new deadline to e-file a 2022 tax return will be October 16, 2023. Learn below if you should even file an extension or not; if you are owed a tax refund, then according to the IRS, a tax extension is not necessary. You can e-file Form https://turbo-tax.org/ 4868 or Form 2350 for free on eFile.com. You can file an extension for your taxes by submitting Form 4868 with the IRS online or by mail. Filing an extension for your taxes gives you additional months to prepare your return no matter the reason you need the extra time.

If you file online, you can expect to receive your refund within 2 weeks. If filing on paper, you should receive your refund within 6 weeks. Many of the forms are fillable, Adobe Reader Version 11+ includes a feature that allows a fillable form to be saved. You may also save the form as a PDF to your computer, complete the form, and then print and mail the form to the address listed.

We give you an automatic 6-month extension to file your return. You must file by the deadline to avoid a late filing penalty. "Filing a tax extension eliminates any late tax payment penalties." If you have everything you need—documents, forms—to file taxes, then preparing and e-filing a tax return by Tax Day, even if you can't pay all or some of your taxes, will save you time.

State of Georgia government websites and email systems use “georgia.gov” or “ga.gov” at the end of the address. Before sharing sensitive or personal information, make sure you’re on an official state website. Forms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google™ translation application tool. For forms and publications, visit the Forms and Publications search tool. The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes.

In addition, we can perform regular reviews of your financial reports and help manage your books. This can free up your employees’ work schedule, allowing them to continue innovating in your field. The team at Sabo Accounting & Tax Services is composed of experienced financial professionals committed to delivering reliable and accurate services. One of their key strengths is providing real-time financial bookkeeping in houston data, which is crucial for making informed decisions. The firm also offers several helpful resources on their website, including the direct web addresses for claiming tax refunds in each state.

At Books by Berry, we are proud Houston bookkeepers offering a full suite of services tailored to your unique needs. Our bookkeeping services include everything from day-to-day bookkeeping to financial analysis and advice. Whether you're a startup looking for small business bookkeeping in Houston or an established enterprise needing comprehensive financial reporting, we've got you covered. Naomi's Tax & Bookkeeping Services is a premier tax and accounting firm located in the city of Humble, TX. With this company's services clients won't need to sweat for another tax season because they will have assistance with their personal taxes, business taxes, bookkeeping, and notary services.

Alfredo Gaxiola CPA strives to render the best quality services to its clients. Cox CPA Services is a premier certified public accounting firm located in https://www.bookstime.com/ the city of Houston, TX. This company offers various services to take the stress out of tax time such as financial statement services, account edge consulting, QuickBooks consulting, bookkeeping, and remote support. With over 21 years of experience, Cox CPA Services guarantees excellent customer service that delivers personalized and professional assistance.

You'll also need to decide whether to hire an in-house bookkeeper or outsource the service to a specialized provider. Things like bookkeeping, accounting, and record keeping become painless. Monthly reporting is a breeze, and your daily operations have never been smoother—all because you aren’t buried in the books every day. The firm’s pricing is structured into five tiers, based on the client’s monthly expenses, ensuring that businesses of various sizes can find a plan that fits their budget. From Tier One for expenses under $20,000 to Tier Five for expenses over $100,000, each tier is designed to cater to different financial needs.

Professionals can clean up erratic accounting entries and manage cash flows to give a clear picture of your business’s financial position. We offer warranties for our services and guarantee the safety and efficiency of our offers. Our bookkeeping agency in Houston, TX can work closely with your employees to incorporate your payroll data into the utilized accounting systems. At the same time, we can collaborate with third-party professional payroll management firms. Our employees at ProLedge offer limited business tax preparation services and can ensure you comply with the financial regulations applicable in Texas.

Join over 25,000 US-based business owners who have streamlined their finances and have grown their businesses with Bench. We can integrate your financial services with the other applications utilized by your staff and set up QuickBooks to handle your internal work processes. Our dedicated team is ready to handle all your bookkeeping necessities. Give yourself peace of mind and let our account managers take care of your financial statements. They came to my rescue 3 years in a row, with my backed-up bookkeeping needs, in a timely and professional manner.

We utilize professional accounting software like QuickBooks for our bookkeeping services and can help bring your firm’s productivity to a superior level. 1-800Accountant Houston has catered to over 100,000 small businesses since 1999. The firm serves a range of clients, from trucking companies and real https://www.instagram.com/bookstime_inc estate agents to e-commerce stores and nonprofits.

Content

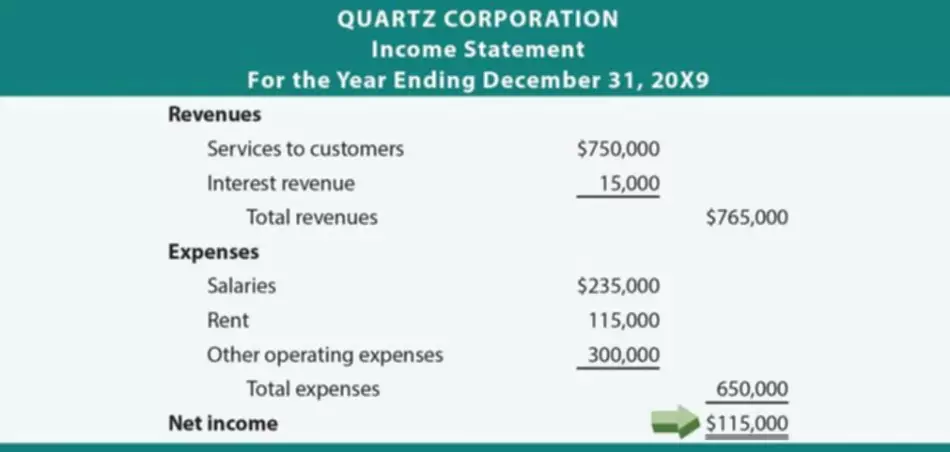

Doing this allows managers to track the growth (or contraction) of their sales of various goods and services. While gross profits precede net profits, the former can be used for more than just calculating the latter. Gross profits provide a view of your company's financial health as it pertains to the cost of goods sold. Your net profit is going to be a much more realistic representation of your company's profits.

You’ll use this formula to calculate how much of your business’s gross income is left over after accounting for all of the company’s expenses. While income indicates a positive cash flow into a business, net income is a more complex calculation. Profit commonly refers to money left over after expenses are paid, but gross profit and operating profit depend on when specific income and expenses are counted. Net income is gross profit minus all other expenses and costs and other income and revenue sources that are not included in gross income. Some costs subtracted from gross profit to arrive at net income include interest on debt, taxes, and operating expenses or overhead costs. Lenders and financial institutions use net income information to assess a company's creditworthiness and to make lending decisions.

From the above, you can see that Apple’s net income is smaller than its total revenue. The reason is that the net income considers Apple’s expenses over that period. The terms income and revenue are sometimes used synonymously; however, net income, or the bottom line, represents the total earnings after accounting for any additional income and any expenses. https://kelleysbookkeeping.com/ Revenue refers to the total amount of money that a business generates from the sale of goods and services. It is also referred to as the top line since it is added to the top of the income statement. The most significant difference is gross income is almost always larger, because it doesn’t reflect the additional expenses that result in net income.

You sold a total of 15k shoes that quarter, but 3k of them were discounted. Additionally, 200 full-price shoes were returned, and 100 discounted shoes were returned. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein.

The difference between gross profit and net profit is the kinds of business expenses you subtract from those earnings. In most cases, investors are more interested in a business’s gross revenue as it shows the ability of the business to generate sales and its potential for growth. If you’ve just released a new SaaS offering, your gross revenue will be extremely important to track to see the viability of your new subscription service. Overhead—such as rent, utilities, payroll, marketing and advertising, and business insurance—isn’t directly tied to producing goods or services. These generally don’t change very much based on a company’s output and sometimes they’re referred to as fixed costs. These other expenses include selling, general, and administrative (SG&A), commonly known as overhead; noncash expenses for the depreciation of assets; interest on debt; and income taxes.

Gross revenue is extremely helpful for tracking your sales volume and ensuring that your company’s market share is growing and that your salespeople are hitting their goals. However, it provides little insight into your company’s overall profitability. Gross Profit Vs Net Income Before you grow your net profit margins, you need to have a baseline of your current profits and a method for consistently measuring them. Businesses typically carry various debts across loans and credit cards, which can eat into profits.

Finally, calculate the amount of money that you won’t earn from the allowances. In this case, that refers to the $30 discount, which applies to the 3k shoes you sold on sale. Revenue and profit are both good signs for your business, but they're not interchangeable terms.

” While keeping an eye on net income is always a good idea, it doesn’t tell you everything you need to know about your company’s profitability. Net income is also referred to as the “bottom line” since it is the last item on an income statement. The value of net income tells whether your business is profitable or not. It is the sum of all your client billings before taxes, expenses, or withholding.

Content

But in the accounting world, “financial consolidation” is a well-defined process that includes several complexities and accounting principles. Also referred to as amalgamation, consolidation can result in the creation of an entirely new business entity or a subsidiary of a larger firm. The term consolidate comes from from the Latin consolidatus, which means "to combine into one body." Whatever the context, to consolidate involves bringing together some larger amount of items into a single, smaller number. For instance, a traveler may consolidate all of their luggage into a single, larger bag.

The term consolidate in accounting refers to combining two or more entities into one entity. It originates from the Latin "consolidatus" meaning "made solid." It helps to simplify financial statement analysis and interpretation. The concept of consolidation has been around for centuries, but it was in the twentieth century that it became formally used in accounting. Print and review the financial statements for the parent company, and investigate any items that appear to be unusual or incorrect. In addition, you can use the Global Consolidation System to create elimination sets, which are a variation of General Ledger's recurring journals.

One such term is "merge" or "merging." Merging involves combining two companies into one company with only one legal entity. Companies usually do this with similar products or services and want to cut costs by merging operations and resources. Consolidation can be helpful for businesses with different subsidiaries or divisions as it allows them to understand their overall performance and financial position better.

Once you’ve completed all of these steps, you can officially close out the period for both your subsidiaries and your parent company. Finalize your balance sheet, P&L, and cash flow statement for reporting to both internal and external stakeholders. The complexity of the financial consolidation process https://www.bookstime.com/articles/consolidation-accounting-definition increases as companies get bigger, expand into more entities, and have greater volumes of intercompany transactions. However, the basic steps of the consolidation process remain the same whether you’re a small startup opening its first subsidiary or you’re a large multinational organization.

The process begins with identifying all related entities within the consolidation group and then incorporating them into one reporting entity. It requires consolidation adjustments such as eliminating inter-company transactions and accounts receivables and recognizing goodwill when appropriate. The purpose of consolidation is to present information about the performance and position of all companies within the parent company's economic environment as one monetary unit. It allows investors to understand better how well the parent company manages all its subsidiaries together rather than viewing them separately. Combining two or more companies involves the combination of ownership, assets and liabilities into one single entity.

Generally, a parent company and its subsidiaries will use the same financial accounting framework for preparing both separate and consolidated financial statements. Financial consolidation is an accounting process where companies combine the data from all of their subsidiaries and other entities into a single set of financial statements for the parent company. This process gives executives and stakeholders of the parent company a view into company-wide financial performance. A consolidation worksheet is created by combining financial data from all of the organizations or divisions of the company. Each division must report accurate data to ensure the company totals are also accurate.

Later, the development of new technologies enabled accountants to render more accurate results from consolidations, thus leading to a greater understanding of corporate financials. It yielded better insights into business operations, allowing companies to make informed decisions, leading to tremendous success and efficiency. Consolidation was first used as a tool by early accountants who sought to combine separate statements from individual companies into one comprehensive statement of accounts. It allowed for easier comparison between companies and improved upon traditional methods that were labor-intensive and often inaccurate at the time. Flag the parent company accounting period as closed, so that no additional transactions can be reported in the accounting period being closed. From the Global Consolidation System you can access General Ledger standard reports and the Financial Statement Generator.

The purchasing company takes control of the target company by purchasing its shares or acquiring its assets. Mergers occur when two distinct companies combine to form a new, larger, single company. We undertake various activities to support the consistent application of IFRS Standards, which includes implementation support for recently issued Standards. We do this because the quality of implementation and application of the Standards affects the benefits that investors receive from having a single set of global standards. When the amount of stock purchased is between 20% and 50% of the common stock outstanding, the purchasing company's influence over the acquired company is often significant. Improved compliance also means companies can present more reliable information to stakeholders, increasing confidence in their accounting practices.

The criteria for filing a consolidated financial statement with subsidiaries is primarily based on the amount of ownership the parent company has in the subsidiary. Part of mapping subsidiary data to the central chart of accounts includes pulling FX rates for currency translation of international financial data to the reporting currency. If you’re a U.S.-based company with a Canadian subsidiary, you’ll need to make sure actuals in CAD translate into USD for the consolidated GAAP financial statements. For effective currency conversions, you’ll need the FX rate for your period end date to translate balance sheet data and the average FX rate for the period for your P&L statement.

The main purpose of consolidated financial statements is to portray an accurate picture of the group's financial position, including assets, expenses, profits and equity. Some of the benefits of this are: Potential investors can judge the financial health of the group and its subsidiaries.

Parent companies/investors owning less than 20% to over 50% of a company’s shares may use the equity consolidation method for reporting. This method is often used when one entity in a joint venture clearly wields more influence over the venture (than the other entity). The main purpose of financial consolidation is to provide an accurate and comprehensive view of a company’s financial performance to executives and stakeholders. When a parent company owns or controls numerous subsidiaries, it can be difficult to combine the different arms of the business into a coherent financial picture; proper consolidation accomplishes this. Start the process of consolidating financial information by mapping subsidiary data to the parent company’s chart of accounts. This includes recording intercompany loans and allocating corporate overhead as necessary.