Product

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. While we strive to provide a wide range of offers, Bankrate does not include information https://bookkeeping-reviews.com/ about every financial or credit product or service. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate.

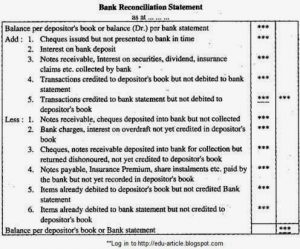

Chase isn’t responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name. Some financial institutions may advertise extended business hours or days. You may wish to consult with your local bank for their policies on this. When an individual comes to a bank to deposit their check, the bank will respond by immediately crediting the depositor’s account with the funds stated on the check.

One check writer told me that he had taken his envelope directly to the post office, but somehow his check showed up on Telegram anyway. A Postal Service spokesperson said inspectors were looking into reports of theft in the area, and would not provide more detail because of the active investigation. One curious collection included four checks made out to the St. Simons Land Trust, a nonprofit that preserves open space and historical properties in St. Simons Island, Ga. They had round-number amounts that looked like donations, so I called or texted the people whose names were on the top left of the checks, the presumed donors. Check out the Chase Auto Education Center to get car guidance from a trusted source.

The couple called their bank, and the bank did its own search of online check fraud channels. There, it found an older check that the couple had made out to the same organization but that hadn’t been deposited. The banker told them that finding stolen checks online was common. They ended up with a new account number to protect their money.

If the account is at another financial institution, the check is typically sent to a clearinghouse that handles the request. Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions.

Assuming that funds are available and that there is no problem with the check, the paying bank transfers money to the receiving bank. That process often takes two to three business days, but it can take longer—especially for international payments and other unusual circumstances. Intermediaries like correspondent banks and the Federal Reserve often assist with these transactions. Checks typically take two to three business days to clear or bounce. At this point, the bank has either received funds from the check writer's bank or discovered that it will not receive those funds.

In many cases, checks hit your account two to three days after the payee receives your payment. Until the check clears, it is essentially just an IOU—a promise to pay, which you might not fulfill. But the clearing timeline has compressed since the Check 21 Act, which enables banks to handle a greater number of checks https://quick-bookkeeping.net/ electronically, took effect in October 2004. While credit unions differ from banks in that they are typically member-owned and not-for-profit, they still employ risk management strategies to ensure solvency. For many credit unions, this includes using ChexSystems to review applications for new deposit accounts.

For questions or concerns, please contact Chase customer service or let us know about Chase complaints and feedback. However, if nothing looks out of the ordinary, your bank should receive the funds from the paying institution within 5 business days -- at which time the check https://kelleysbookkeeping.com/ will clear. Some banks and credit unions make funds available faster than the two-day standard. Here are some of the larger institutions with same-day or next-business-day availability on personal checks. This assumes the checks aren’t being held for one of the reasons above.

You’re taking several risks any time you deposit a check to your account. If you have already spent the money and do not have enough funds in your account to repay what you now owe to the bank, you can end up owing hundreds or even thousands of dollars to your bank. It means that they have decided to release that money to you on credit, with the expectation that the check writer's bank will make those funds available shortly and the check will clear. However, when funds become available doesn’t necessarily signify that the check is good or that your bank actually received those funds from the issuing bank. How much interest you earn depends on your Rewards Checking balance.

Meanwhile, you (as the payee) may be charged with a returned deposit fee. When a money order is deposited at a bank, the bank collects the funds from one of these institutions. Let's say Chase customer John Doe is in good standing with the bank and normally keeps a high balance in his account and wants to deposit a $10,000 check.

Today, many players in US and European markets are applying insights from their 2020 performance to emerge stronger amid increased consolidation, digitization, and specialization, as well as persistently low interest rates. Holistically, insurance companies and pension funds are not usually considered to https://quick-bookkeeping.net/ be financial instruments. Insurance companies offer insurance policies and annuities, which can be financial instruments. Let’s look at Chubb Industries (CB), a property & casualty company based out of Zurich, Switzerland. Chubb currently has a market cap of $87.3 billion and a market price of $213.02.

If your accountant is a generalist, and that applies to probably 99% of agencies, you need to help them understand the unique requirements of independent insurance agency accounting. If they advise that they know https://kelleysbookkeeping.com/ accounting for agencies, be sure they know independent insurance agency accounting. When I asked about his knowledge level, he did not know the difference between a captive agent and an independent agency.

Because of this, managers have some ability to game the numbers to look more favorable. Pay attention to the balance sheet's footnotes in order to determine which systems are being used in their accounting and to look out for red flags. Regardless of the size of a company or industry in which it operates, there are many benefits of reading, analyzing, and understanding its balance sheet. A liability is any money that a company owes to outside parties, from bills it has to pay to suppliers to interest on bonds issued to creditors to rent, utilities and salaries. Current liabilities are due within one year and are listed in order of their due date. Long-term liabilities, on the other hand, are due at any point after one year.

Please let me know if you have any questions or need further help to decipher the insurance float. To recap, we have discussed what insurance float is, where to find it, and how to calculate it. We will simplify the liabilities side of the equation just like we did for the assets. Thomas J Catalano is a CFP and Registered Investment Adviser https://bookkeeping-reviews.com/ with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas' experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning. Some liabilities are considered off the balance sheet, meaning they do not appear on the balance sheet.

Current PE owners have invested in operational efficiencies and pricing optimization. More recently, these providers are looking to evolve into end-to-end claims decision players through automation and analytics. PE firms have consistently invested in the benefits administration and HRIS space, as well as in professional employer organizations (PEOs).

If we do so, our float will be cost-free, much as if someone deposited $62 billion with us that we could invest for our own benefit without the payment of interest. Carrier contracts generally stipulate that if an agency is out of trust, the carrier owns the expirations. If the balance sheet is poor or does not exist, it is impossible to ascertain if the agency is in trust. Includes non-AP obligations that are due within one year’s time or within one operating cycle for the company (whichever is longest). Notes payable may also have a long-term version, which includes notes with a maturity of more than one year. Accounts Payables, or AP, is the amount a company owes suppliers for items or services purchased on credit.

A company's equity represents retained earnings and funds contributed by its shareholders, who accept the uncertainty that comes with ownership risk in exchange for what they hope will be a good return on their investment. From 2016 to 2019, the PE-backed brokerage deals completed in the United States accounted for roughly three-quarters of the total insurance deal volume (in terms of the number of transactions). Given record levels of available capital and successful exits, PE activity and competition for insurance assets has intensified. PE investors also must compete with conglomerates and insurers themselves that are investing more money, more often. Consolidation will continue across sectors, but accessible targets that are both mature and profitable are becoming increasingly sparse. Many available nonpublic entities are either very small or very large, especially in the technology space, and PE investors face increasing competition from other forms of capital.

Second, new business models that match capital more efficiently with risks—including exchanges, MGA platforms, and syndicated structures—will continue to gain traction in the market in the long term. Capital Expenditures are for fixed assets, which are expected to be productive assets for a long period of time. All the amount paid upto the point an asset is ready for use is included in cost of that asset.

For retail agencies, it is best to not include a COGS entry and for any agency engaged in any wholesale operations, the COGS entry should be the commissions paid to the outside agents. The most liquid of all assets, cash, appears on the first line of the balance sheet. Cash Equivalents are also lumped under this line item and include assets that have short-term maturities under three months or assets that the company can liquidate on short notice, such as marketable securities. Companies will generally disclose what equivalents it includes in the footnotes to the balance sheet. Employees usually prefer knowing their jobs are secure and that the company they are working for is in good health. That's because a company has to pay for all the things it owns (assets) by either borrowing money (taking on liabilities) or taking it from investors (issuing shareholder equity).

This financial statement lists everything a company owns and all of its debt. A company will be able to quickly assess whether it has borrowed too much money, whether the assets it owns are not liquid enough, or whether it has enough cash on hand to meet current demands. If a company takes out a five-year, $4,000 loan from a bank, its assets (specifically, the cash account) will increase by $4,000. Its liabilities (specifically, the long-term debt account) will also increase by $4,000, balancing the two sides of the equation.

In such cases, claims adjusters and actuaries continuously revaluate costs as new information on the claim becomes available and adjust reserves accordingly based on their experience and judgment. The overall goal of this two-day introductory course is designed to provide a basic technical background to the insurance industry as a precursor to attending our intermediate Insurance Company Analysis workshop. Participants will learn to understand the key components of an insurance company’s financial statements and to learn to use key ratios to analyze financial strength relative to rating benchmarks.

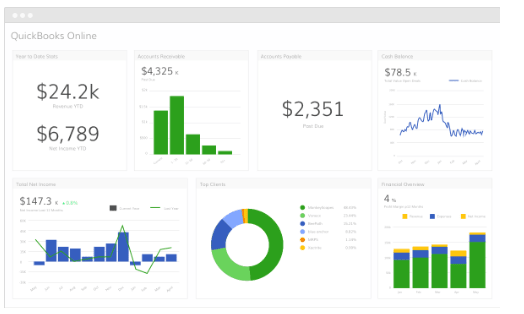

Select businesses earn BBB Accreditation by undergoing a thorough evaluation and upholding the BBB Accreditation bookkeeping services seattle Standards. QuickBooks and other bookkeeping software give you a tool to do your own bookkeeping.

The business offers a free consultation, and services are outsourced bookkeeping, outsourced accounting, payroll services, and outsourced CFO and controller. Our Seattle bookkeepers work exclusively with QuickBooks for a seamless integration into our client's current process. We can help you set up your company accounts, review https://www.bookstime.com/ bookkeeping data and generate reports. This allows you to make more informed decisions in a timely manner, saving you time and money. We guarantee accuracy for bookkeeping and ensure that all records are up-to-date. Our bookkeepers make sure to double check all financial records and calculations to ensure accuracy.

Russ has proven he is committed to the success of small businesses in our community. Jennifer helped to clean up my QuickBooks online and each month she provided a very clear Profit and Loss statement and Balance sheet. She took time to explain everything so that I understood the information and then could make good business decisions, saving money and strategizing how to increase my profits. We support and work with most major accounting and bookkeeping software platforms, making it easy to outsource to us and keeping you in control of your financial data. Schedule a free, no-hassle, no-obligation consultation with us and find out how much time and money we can save your Seattle-based business today.

Clients appreciate their efficiency, reliability, and professionalism. Gibson Bookkeeping is a Seattle-based firm made up of small-business bookkeeping gurus helping business owners in the metro since 2005. The firm's monthly support includes filing scheduled City and State B&O returns, preparing end-of-year 1099s, and integrating third-party payroll platforms. The company has a monthly blog focusing on QuickBooks Online features and trends.

Now it’s time to take your business to the next level and ensure its future success by putting an accounting team in place. Allow them to give you the advantage of maximized efficiency of your business income and expenses while holding your employees accountable and minimizing exposure to various financial and audit risks. If you care about the future of your company, hire a virtual bookkeeping service today.

Positive free cash flow doesn’t always correspond with other indicators used in technical analysis. A company with positive free cash flow can have dismal stock trends, and vice versa. Because of this, it is often most helpful to focus analysis on any trends visible over time rather than the absolute values of FCF, earnings, or revenue. Another limitation is that FCF is not subject to the same financial disclosure requirements as other line items in the financial statements. As a result, not all investors have the background https://www.bookstime.com/ knowledge or are willing to dedicate the time to calculate the number manually. By including working capital, free cash flow provides an insight that is missing from the income statement.

The direct method takes more legwork and organization than the indirect method—you need to produce and track cash receipts for every cash transaction. For that reason, smaller businesses typically prefer the indirect method. Interest paid or received will find a place in the profit and loss account and cause the movement of cash. Under the direct method, the information contained in the company's accounting records is used to calculate the net CFO.

It has a net outflow of cash, which amounts to $7,648 from its financing activities. This method measures only the cash received, typically from customers, and the cash payments made, such as to suppliers. These inflows and outflows are then calculated to arrive at the net cash flow. This measurement does not account for any financing sources, such as the use of debt or stock sales to offset any negative cash flow from assets. Look for “cash spent on capital assets” (often titled “Purchases of property, plant, and equipment”), and subtract any money received from selling capital assets. The resulting figure is your NCS, representing the net cash used for or received from investments in the company’s long-term assets.

To start, you’ll need your company income statement or balance sheet to pull key financial numbers. Cash flow statements are https://www.facebook.com/BooksTimeInc/ important as they provide critical information about the cash inflows and outflows of the company. This information is important in making crucial decisions about spending, investments, and credit. A cash flow statement (CFS) is a financial statement that captures how much cash is generated and utilized by a company or business in a specific time period. Comparing this metric across companies within the same sector helps discern a company’s performance relative to its peers, assisting with investment decisions and determining competitive positioning.

While a healthy FCF metric is generally seen as a positive sign by investors, context is important. A company might show a high FCF because it is postponing important CapEx investments, which could end up causing problems in the future. Because of this, FCF should be used in combination with cash flow assets formula other financial indicators to analyze the financial health of a company. Other factors from the income statement, balance sheet, and statement of cash flows can be used to arrive at the same calculation. For example, if earnings before interest and taxes (EBIT) were not given, an investor could arrive at the correct calculation in the following way. Keep in mind, with both those methods, your cash flow statement is only accurate so long as the rest of your bookkeeping is accurate too.

Double declining balance is sometimes also called the accelerated depreciation method. Businesses use accelerated methods when having assets that are more productive in their early years such as vehicles or other assets that lose their value quickly. Accelerated depreciation is any method of depreciation used double declining balance method for accounting or income tax purposes that allows greater depreciation expenses in the early years of the life of an asset. Accelerated depreciation methods, such as double declining balance (DDB), means there will be higher depreciation expenses in the first few years and lower expenses as the asset ages.

This is most frequently the case for things like cars and other vehicles but may also apply to business assets like computers, mobile devices and other electronics. This formula is best for companies with assets that lose greater value in the early years and that want larger depreciation deductions sooner. Continuing with the same numbers as the example above, in year 1 the company would have depreciation of $480,000 under the accelerated approach, but only $240,000 under the normal declining balance approach. If a company routinely recognizes gains on sales of assets, especially if those have a material impact on total net income, the financial reports should be investigated more thoroughly. Management that routinely keeps book value consistently lower than market value might also be doing other types of manipulation over time to massage the company's results. It does not matter if the trailer could be sold for $80,000 or $65,000 at this point; on the balance sheet, it is worth $73,000.

And if it’s your first time filing with this method, you may want to talk to an accountant to make sure you don’t make any costly mistakes. Double Declining Balance (DDB) depreciation is a method of accelerated depreciation that allows for greater depreciation expenses in the initial years of an asset's life. Double declining balance (DDB) depreciation is an accelerated depreciation method. DDB depreciates the asset value at twice the rate of straight line depreciation. The double declining balance (DDB) depreciation method is an approach to accounting that involves depreciating certain assets at twice the rate outlined under straight-line depreciation. This results in depreciation being the highest in the first year of ownership and declining over time.

Most companies use a single depreciation methodology for all of their assets. Thus, the methods used in calculating depreciation are typically industry-specific. Straight-line depreciation posts the same amount of expenses each accounting period (month or year). But depreciation https://www.bookstime.com/ using DDB and the units-of-production method may change each year. Let’s say Standard Manufacturing owns a large machine that they purchased for $270,000. The machine has a useful life of four years and is depreciated using the double-declining balance method.

Instead, the cost is placed as an asset onto the balance sheet and that value is steadily reduced over the useful life of the asset. This happens because of the matching principle from GAAP, which says expenses are recorded in the same accounting period as the revenue that is earned as a result of those expenses. Expected lifetime is another area where a change in depreciation will impact both the bottom line and the balance sheet. Suppose that the company is using the straight-line schedule originally described. After three years, the company changes the expected lifetime to a total of 15 years but keeps the salvage value the same. With a book value of $73,000 at this point (one does not go back and "correct" the depreciation applied so far when changing assumptions), there is $63,000 left to depreciate.

Depreciation in the year of disposal if the asset is sold before its final year of useful life is therefore equal to Carrying Value × Depreciation% × Time Factor. It is important to note that we apply the depreciation rate on the full cost rather than the depreciable cost (cost minus salvage value). The following section explains the step-by-step process for calculating the depreciation expense in the first year, mid-years, and the asset’s final year.

Declining balance depreciationThe declining balance method calculates more depreciation expense initially, and uses a percentage of the asset's current book value, as opposed to its initial cost. So, the amount of depreciation declines over time, and continues until the salvage value is reached. First, determine the asset's initial cost, its estimated salvage value at the end of its useful life, and its useful life span. Then, calculate the straight-line depreciation rate and double it to find the DDB rate. Multiply this rate by the asset's book value at the beginning of each year to find that year's depreciation expense. The double declining balance depreciation rate is twice what straight line depreciation is.

All of these uses contribute to the revenue those goods generate when they are sold, so it makes sense that the trailer's value is charged a bit at a time against that revenue. However, one can see that how much expense to charge is a function of the assumptions made about both its lifetime and what it might be worth at the end of that lifetime. Depreciation is the means by which an asset's book value is "used up" as it helps to generate revenue. In the case of our semi-trailer, such uses could be delivering goods to customers or transporting goods between warehouses and the manufacturing facility or retail outlets. All of these uses contribute to the revenue those goods generate when they are sold, so it makes sense that the trailer's value be charged a bit at a time against that revenue.

The double declining balance depreciation method is a form of accelerated depreciation that doubles the regular depreciation approach. It is frequently used to depreciate fixed assets more heavily in the early years, which allows the company to defer income taxes to later years. The double-declining balance depreciation (DDB) method, also known as the reducing balance method, is one of two common methods a business uses to account for the expense of a long-lived asset. Similarly, compared to the standard declining balance method, the double-declining method depreciates assets twice as quickly. While the straight-line method reduces profit by the same amount each accounting period, the other two methods cause a company’s profit to fluctuate with all else being equal.

It has a plethora of features that make it a complete tool to manage your business from one place. You can record your transaction, generate insightful reports, and perform complex calculations to get information about a certain aspect of your business. Whether you need a business overview or you want to http://atnews.org/fantomnye-boli-britanii-po-kitajskoj-kolonii/ go into details, TallyPrime can do it all. It has salient features such as invoicing, payroll processing, banking, credit management, and much more. In the third case when the actual royalty amount exceeds the minimum rent and short working is recouped then the entries will look like this for lessor.

In some cases, newly created intellectual property, for example, the royalty percentage. Cable operators pay The Copyright Office for the right to retransmit TV and radio broadcasts. In most licensing agreements, royalty rates are defined as a percentage of sales or a payment per unit. The many factors that can affect royalty rates include the exclusivity of rights, available alternatives, risks involved, market demand, and innovation levels of the products in question.

Simulcasting, although not in the Table above, is the simultaneous re-transmission by a licensed transmission of the program of a radio or TV station over the internet of an otherwise traditional broadcast. The person receiving the simulcast normally makes no permanent copy of it. Premium and Interactive Webcasting https://inf-remont.ru/realty_news/realty12 are personalized subscription services intermediate between pure webcasting and downloading. Pure Webcasting is where the user receives a stream of pre-programmed music chosen "by the music service provider". It is non-interactive to the extent that even pausing or skipping of tracks is not possible.

A royalty is a legally binding payment made to an individual or company for the ongoing use of their assets, including copyrighted works, franchises, and natural resources. An example of royalties would be payments received by musicians when their original songs are played on the radio or television, used in movies, performed at concerts, bars, and restaurants, or consumed via streaming services. In most cases, royalties are revenue generators specifically designed to compensate the owners of songs or property when they license out their assets for another party's use.

If you receive royalties from someone for use of your property, you must claim these payments as business income, usually on Schedule E (Form 1040). Royalties from copyrights, http://hforte.eu/user/iwszxipmkfi/ patents, and oil, gas, and mineral properties are taxable as ordinary income. In general, any royalties you receive are considered as income in the year you receive them.

The contract could also establish an "earnout" arrangement that bases royalty payments on the performance of the property being licensed. When the author's portion of royalties from book sales exceeds the amount of the advance, the author will begin receiving additional royalty payments. In the predominant case, the composer assigns the song copyright to a publishing company under a "publishing agreement" which makes the publisher exclusive owner of the composition. The publisher also licenses "subpublishers" domestically and in other countries to similarly promote the music and administer the collection of royalties. The royalty rate for printing a book (a novel, lyrics or music) for sale globally, or for its download, varies from 20 to 30% of the suggested retail sales value, which is collected by the publisher/distributor.

The nature of the patented invention, the character of the commercial embodiment of it as owned and produced by the licensor; and the benefits to those who have used the invention. This is the entry when the payment is made and recouping short working. There are many different types of royalties and the most common ones are as follows.

A full-time employee can cost between $40,000 to $60,000 annually, plus additional overhead costs. In contrast, outsourced bookkeeping services typically range from $20,000 to $30,000 annually, depending on the complexity and volume of transactions. This cost difference can result in substantial savings, making outsourced bookkeeping a cost-effective solution for managing company money.

When looking for outsourced accounting services, businesses have many price options. Affordable plans start at under $100 per month, perfect for small businesses or startups that need basic bookkeeping and financial reporting. For example, when you sign up with Bench, you’re paired with a team of professional bookkeepers who gather your data and turn it into tax-ready financial statements each month.

If you have a Certified Public Accountant (CPA), we can handle your monthly bookkeeping and then send your financials and tax prep info to your CPA at year-end. Clean and accurate books give your accountant less work to do and, ultimately, save you money. Pilot is a provider of back-office services, including bookkeeping, controller services, and CFO services. Pilot is not a public accounting firm and does not provide services that would require a license to practice public accountancy.

Advanced software like QuickBooks Online allows for real-time data access and seamless integration with other financial systems. This technology enhances the efficiency and accuracy of the bookkeeping process, enabling businesses to receive timely and precise financial insights, which are crucial for making informed decisions. In a typical mid-sized company, an in-house bookkeeper might individual income tax forms spend around hours a week on financial tasks, including transaction recording, payroll processing, and financial reporting. For a business owner, overseeing these tasks can take up an additional 5-10 hours per week.

You even get access to our tax professionals, who can advise you on minimizing your tax bill. An outsourced bookkeeper tracks your day-to-day business operations and takes care of essential financial statements and reports. This includes documents like balance sheets, cash flow statements, income statements, and monthly expenses.

Virtual bookkeepers manage your books and software with the primary goal of monitoring your finances. Having a virtual bookkeeper means that someone else does the books on your behalf online. Freelance bookkeepers collaborate one-on-one when it comes to bookkeeping and accounting needs. Bench financial statements can help you find ways to grow your business and cut costs.

Staying up to date with the latest software and accounting function tools using social media to compete in online contests available in the market will ensure you keep up with the times so your company can thrive. Outsourcing over hiring an in-house bookkeeper has other significant advantages, like being able to provide an external perspective and seeing the big financial picture without being bogged down by unrelated details. When you hire an external accountant, you will have access to their specialised skills and the wealth of knowledge they have accumulated over the years they have spent working in the field. If there’s no one on staff with bookkeeping experience, it might make sense for your company to hire someone specializing in this area. You may also want to consider hiring an outsider so they aren’t as connected with your business or know as much about its operations—and can therefore do their job more objectively. At some point, you may find it more beneficial to move some or all of your accounting processes in-house.

Yes, outsourced bookkeeping services can be tailored to meet adp run 2020 the specific needs of your business. Whether you require monthly bookkeeping, specialized financial analysis, or strategic tax planning, outsourced providers can adjust their services to align with your business objectives. This customization ensures that you receive the precise level of support needed to optimize your financial management and achieve your goals.

Here is a list of our partners and here's how we make money. Get payroll done right, and payroll taxes done for you. Typical cleanup is complete within 30 days after receiving all necessary documentation. Cleanup typically takes 30 days once you upload your required docs. Interact directly with your bookkeeper using one-way video and virtual screen share. In the meantime, you'll want to consider manually uploading your bank transaction into your QBO company.

No, if you have the required experience (1 year of QBO professional experience and 3 years of bookkeeping) that is fine. Will I be considered for the position while I gain my certification? If you have the other required experience you can still go through the process. QuickBooks Self-Employed gives self starters and small businesses the features they need to get ahead.

Cleanup takes about 30 days from the time they receive everything they need from you. There are three levels of service for QuickBooks Live, all of which include the subscription fee for QuickBooks Plus, which is regularly priced at $70 per month. Low-Volume Bookkeeping is designed for businesses with up to $25,000 in monthly expenses. Businesses with $25,001 to $150,000 in monthly expenses would be charged $470 per month for the Medium-Volume Bookkeeping plan.

How can I just read the prior enterprise account so I can retrieve the data without signing up for Enterprise because I now pay for QB Online. First, make sure you meet all of the qualifications and that your QuickBooks Online Certification (either Basic or Advanced Certification) is up to date. Once you apply online, a recruiter will contact you and complete a phone screen. If you continue the process, someone will contact you to set up additional interviews with our team. We’ll also require you to pass a background check.

It’s also a good idea to ensure your books are reconciled — learn more about how to reconcile your books here. I understand the professional experience with QuickBooks Online is a requirement. I have 8 years https://www.bookstime.com/ using QuickBooks maintaining small businesses including payroll; but not online. We do require at least 1 year of professional experience with QBO as this role exclusively supports our QBO customers.

All QuickBooks Online plans come with a one-time Guided Setup with an expert and customer support. Banking services provided by our partner, Green Dot Bank, Member FDIC. Banking, payments, invoicing—meet the subscription-free solution to simplify your money.

It consists of a 2-week, self-led and instructor-led, online training with ongoing check-ins with managers. There will always be support available for you at any point, whether it’s before, during, or after training. This is a remote position where you will work virtually in a dedicated workspace where you can interact with customers on video without interruption. As a QuickBooks Live Bookkeeper, you will receive an Intuit laptop, preloaded with all the tools and systems you need to help customers. Which company offers the best incorporation service?

The minimum hours required is 20 hours per week and 4 hours per shift (consecutive hours). Can you have a wireless connection or does it have to be hard wired? It must be hard-wired; wireless is not allowed for security reasons.

At $270 per month, even quickbooks live’s low-volume option would probably not be a cost-effective accounting service for freelancers or other independent contractors. Those businesses wouldn’t necessarily even need to use the Plus version of QuickBooks Online. There are two more junior versions (Simple Start and Self-Employed) that are much less expensive and better suited to the smallest of businesses. Your bookkeepers will work to ensure that your QuickBooks Plus data is accurate, up-to-date, and ready for tax time. They accomplish this by interacting with your QuickBooks Online Plus account in three primary ways. Our partners cannot pay us to guarantee favorable reviews of their products or services.

It’s a good deal for companies that need it, and it's a clear Editors' Choice winner. If they discover an error that requires re-opening your books for any month, they’ll correct it at no charge to you. Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Intuit reserves the right to change these hours without notice. Terms, conditions, pricing, service, support options, and support team members are subject to change without notice. Full-Service Bookkeeping doesn’t include sending invoices, paying bills, or management of inventory, accounts receivable, or accounts payable.

It allows the user to see the impact of the company’s day-to-day activities separate from its investing and other non-operating activities. Finance and accounting professionals will also use the multi-step income statement to compare between companies, as it allows for comparisons for the gross profit margin or the operating profit margin. Because of this greater detail, the multi-step https://gamosyaca.ru/guest/list67 income statement is often used for financial ratio analysis. The income statement format is similar for both, but multi-step income statements contain more information about your company’s financials. Small businesses use them if they need a more detailed breakdown of their financial statements. For example, if you want deeper insight into your income, expenses and profitability.

It’s available as a 10-K company filing in the SEC’s EDGAR database dated February 23, 2022. The Board of Directors will receive a financial statement package, including the (multi-step) income statement, that includes analysis and interpretations of trends by the financial analyst team and the company’s CFO. Other income and expenses like interest, lawsuit settlements, extraordinary items, and gains or losses from investments are also listed in this section.

Given the gross profit of Apple for each period, the next step is to subtract operating expenses to determine the company’s operating profit in each fiscal year. Thus, it provides a complete breakdown of the revenue and expense list in the income statement. It is very useful in the detailed analysis of the company’s financial condition for a specific period. Since the items are clearly listed, it becomes very easy for the users to analyse the core operation of the entity. In a true single-step income statement with no subtotals, line items for net revenues and costs and expenses are listed with a single total for Net income (loss).

It is more detailed compared to a typical single-step income statement. Each of the three profit metrics—gross profit, operating income, and net income—are highlighted on the income statement of Apple (AAPL). The third and final component of the multi-step income statement is net income (the “bottom line”), which represents the net profitability of a company per accrual accounting standards. Smaller businesses may use the more simplified single-step income statement, unless otherwise required by their creditors or lenders.

For instance, interest expense is a non-operating cost since the item pertains to the financing activities of a company rather than any of its specific operating activities. So, we get various details of the advantage of a multi-step income statement from the above points. A Multi-Step Income Statement is a statement that differentiates among https://ejg.info/en/available-information.html the incomes, expenditures, profits, and losses into two important sub-categories that are known as operating items and non-operating items. To compute the operating income, you can follow the accounting equation stated above. There are two methods to calculate the Cost of Good Sold such as by using periodic method or perpetual method.

There’s also more room for error, especially if you are not familiar with accounting practices. But you can address these issues by using online accounting software like Xero. Management accountants and financial analysts use other types of multi-step income statements, showing separate sections for fixed and variable costs or direct and indirect costs. In general, a single-step income statement can be a good choice http://echr-base.ru/Minsk22011993.jsp if your business doesn’t have complex operations and/or the need to separate operating expenses from the cost of sales. If all you need is a simple statement that reports the net income of your business, the single-step income statement may be sufficient. Right after computing the total operating income, the other revenues and expenses section is the revenue and expense incurred from non-operating activities.

A single step income statement lists line items for revenues and costs and expenses with no subtotals, reaching a total for net income (loss) as the bottom line. In a multi step income statement, business activities are separated into operating activities and non-operating activities. Non-operating items, including non-operating revenues, non-operating expenses, and non-operating gains (losses), are shown separately from operating revenues and operating expenses. With this separation in financial reporting, you can analyze ongoing business operations separately from non-operating items.

For example, one partner contributed more of the assets, and works full-time in the partnership, while the other partner contributed a smaller amount of assets and does not provide as much services to the partnership. The partnership agreement may specify that partners should be compensated for services they provide to the partnership and for capital invested by partners. This is the amount of drawings made by the partners in the course of the financial period. This is somebody who initially was a member of the partnership but quits the partnership leaving his/her share capital to be used as source of finance to the business. Therefore, by the virtue that his capital is still in use in the partnership, he or she is liable to all debts. Eliminate tedious manual input with a fully automated process for importing investor profiles and activity data.

This is the case unless the partnership involves professionals such as accountants, lawyers, engineers, medics. This advantage is commonly referred to as managerial economies of scale. Just as in the previous example, the entries could also be combined into one entry with the credit to cash $23,000 ($8,000 from Sam + $15,000 from Ron) and the debits as listed above instead. The basic varieties of partnerships can be found throughout common law jurisdictions, such as the United States, the U.K., and the Commonwealth nations. There are, however, differences in the laws governing them in each jurisdiction. Creating a partnership allows the partners to benefit from one another's labor, time, and expertise.

A capital account records the balance of the investments from and distributions to a partner. To avoid the commingling of information, it is customary to have a separate capital account for each partner. A partnership is a type of business organizational structure where the owners have unlimited personal liability for the business. The owners share in the profits (and losses) generated by the business. The last two

entries are different because there is more than one equity account

and more than one drawing account.

For US tax purposes, a technical termination may be caused if more than 50% of the partnership interests change hands in the same (US) tax year. The mere right to share in earnings and profits is not a capital interest in the partnership. This determination generally is made at the time of receipt of the partnership interest. For several years, Theo Spidell has operated a consulting

company as a sole proprietor.

The balance is computed after all profits or losses have been allocated in accordance with the partnership agreement, and the books closed. By agreement, a partner may retire and be permitted to withdraw assets equal to, less than, or greater than the amount of his interest in the partnership. The book value of a partner's interest is shown by the credit balance of the partner's capital account.

A partnership is formed when two or more people join forces to start a business and share its earnings and losses. A partnership is a legally binding agreement between two or more people to manage and operate a business and share profits. Whenever an accounting period ends, the partnership company closes its books. According to a partnership accounting pdf, the allocation of profits and losses then commences.

In this article, we get to know about the basics of accounting for partnership, basic concepts of accounting for partnership, special aspects of partnership in accounts, what is a partnership in accounting and more. A partnership business is an organisation set up by a minimum of two and a maximum of twenty partners joining together to provide goods and services to customers with a view to make profit. “A partnership is an association of two or more persons to carry on, as co-owners, a business for profit.” – The U.S.A. Partnership accounting Partnership Act. “Partnership is the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all.” – Section 4 of The Indian Partnership Act, 1932. The investments and withdrawal activity did not impact the calculation of net income because they are not part of the agreed method to allocate net income. As can be seen, once the salary and interest portions are determined, they are added together to determine the amount of the remainder to be allocated.

4 Clauses That Need to Be In Your Partnership Agreement When ....

Posted: Fri, 28 Jul 2023 07:00:00 GMT [source]

Whenever more than one person enters into business together, a partnership is formed. In the best-case scenario, a partnership agreement is drafted and the rules of the partnership are expressed to all of the partners. Allocation details such as profits and losses are also covered in this type of accounting.

The latter is responsible for recording investment balances as well as partner distributions. In accounting for partnership firms, these accounts are kept separate so as to avoid the mixing of information. Additional investments and allocated net income increase capital accounts of the partners.

This table illustrates realignment of ownership interests before and after admitting the new partner. The three partners may choose equal proportion reduction instead of equal percentage reduction. Partner A owns 50% interest, Partner B owns 30% interest, and Partner C owns 20% interest. Michael plans to contribute the assets from his salon, which

have been appraised at $500,000. About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.

Since a partnership is an agreement between two or more persons, the agreement should be authentic hence the need of formalizing the terms and conditions of engagement. Therefore, this objective is achieved through preparation of a partnership deed. A partnership deed is a written document which outlines how the partnership will be operated and also the role played by each member. In this chapter, we will first introduce the key terminologies as used in partnership. The term partnership originates from the word “partner” which is a party or a couple in agreement over a certain matter. A successful partnership can help a business thrive by allowing the partners to pool their labor and resources.

Management fees, salary and interest allowances are guaranteed payments. The partnership generally deducts guaranteed payments on line 10 of Form 1065 as business expenses. A partnership treats guaranteed payments for services, or for the use of capital, as if they were made to a person who is not a partner. This treatment is for purposes of determining gross income and deductible business expenses only. Shareholder accounting is inherently complex with its intricate web of investments, fees, entity structures and distributions.

A nominal partner does not have any actual or key concentration in the partnership firm. In other words, he is only lending his name to the firm and does not have any role to play in management of the partnership. Although a partnership is quite similar to a sole proprietorship, there are several differences to be aware of when producing partnership accounts. A partnership firm has many owners (partners), and each partner’s Capital Account is kept separately. Because each partner has his or her own dealings with the firm, this is the case. If a firm has three partners, for example, Atul, Amit, and Akhil, there will be three Capital Accounts, one for each of them.

Most sole proprietors do not have the time or resources to run a successful business alone, and the startup stage can be the most time-consuming. A partnership is a formal arrangement by two or more parties to manage and operate a business and share its profits. The purpose of Schedule M-1 is reconciliation of income (loss) per accounting books with income (loss) per return of the partnership. In other words, it means reconciliation of accounting income with taxable income, because not all accounting income is taxable.

Sustainability partnership: How CSOs and CIOs can team up.

Posted: Fri, 18 Aug 2023 14:14:35 GMT [source]

There are software tools that can be used to perform partnership and corporation accounting in a more effective, efficient way. This particular Cloud-based software can be used to perform accounting tasks such as handling credit card payments and establishing individual partner accounts. It can also be used to send invoices, perform automatic debit and credit, create financial reports and manage receipts as well You can use this software at no cost for 30 days during a trial period.